Investment Thesis: Shopify

This month, we spotlight Shopify, a game-changer in e-commerce that has redefined how businesses operate online. As a leading platform for digital storefronts, Shopify simplifies the complexities of online retail, enabling entrepreneurs to launch, scale, and optimize their businesses with ease. Its intuitive technology, extensive integrations, and data-driven insights have made it an indispensable tool in the digital economy.

With e-commerce growth accelerating, Shopify’s strategic innovations position it for sustained success. Whether you’re an investor seeking long-term potential or a business owner looking for scalable solutions, Shopify remains a compelling player in the evolving retail landscape.

This recommendation is just a start. The next step is to do your due diligence process which will then help you to make the investment decision. We strongly advise investors to do a thorough analysis of the recommendation and understand the soundness of the business before investing in this company. Also, please consult your investment advisor before making a decision.

Business Profile (NYSE: SHOP)

Discover how Shopify leads the digital marketplace by empowering merchants with AI-driven commerce, seamless omnichannel solutions, and a scalable global ecosystem in this AI-generated audio feature.

Explore Shopify's investment thesis—how its rapid revenue growth, expanding merchant base, AI-powered innovations, and strong financial resilience position it as a dominant force in the evolving e-commerce landscape.

Founded in 2006 by Tobias Lütke, Scott Lake, and Daniel Weinand, Shopify has become a leading force in digital commerce, empowering millions of businesses across 175 countries. Its cloud-based platform provides a comprehensive commerce infrastructure, offering customizable templates, seamless integrations, and AI-powered tools that simplify online selling.

Shopify’s all-in-one system streamlines essential operations, from inventory and product management to payments and shipping, ensuring efficiency across multiple sales channels. Entrepreneurs can manage their stores from any device, giving them the flexibility to scale their brands without being held back by complex technology. With e-commerce adoption surging, Shopify continues to drive innovation, making it a compelling player for both businesses and investors alike.

Explore key Shopify statistics that showcase its market influence and rapid growth.

Want to enhance your investing skills? Check out our guide to Books on Investing for insights on spotting winning companies like Shopify.

The Shopify Story: Innovation Born from Necessity

Tobias Lütke, originally from Koblenz, Germany, had a deep passion for technology from an early age. Instead of following a traditional college path, he pursued a hands-on computer programming apprenticeship, sharpening his problem-solving skills through real-world experience. In 2002, he relocated to Canada in search of new opportunities, eventually teaming up with Scott Lake to launch an online snowboard shop.

However, they quickly realized that existing e-commerce platforms were too expensive and complicated for small businesses. Frustrated by these limitations, Lütke used his coding expertise to build a more user-friendly and cost-effective solution—the foundation of what would become Shopify. A few years later, Lütke, Lake, and Daniel Weinand officially launched the platform, with a mission to simplify online retail and empower entrepreneurs worldwide.

Key Milestones in Shopify’s Growth

Shopify has continuously evolved, expanding its features and capabilities to meet the demands of the digital economy:

- 2009: Launched the Shopify App Store, enabling third-party developers to create apps that enhance store customization.

- 2013: Introduced Shopify Payments, streamlining payment processing for merchants.

- 2014: Rolled out Shopify Plus, catering to high-volume businesses with advanced features and dedicated support.

- 2015: Went public (NYSE: SHOP), raising $131 million to fuel expansion and innovation.

- 2017: Strengthened partnerships with Amazon and Facebook, allowing merchants to sell across multiple channels.

- 2019: Acquired 6 River Systems, improving logistics and fulfillment efficiency.

- 2022: Grew into a global powerhouse with over 11,600 employees, solidifying its position as an industry leader.

Shopify’s ability to adapt, innovate, and integrate new technologies has positioned it at the forefront of e-commerce. Today, with Tobias Lütke still at the helm, Shopify continues to empower millions of businesses—from startups to global brands—by removing technological barriers and redefining how online commerce operates.

Learn the key principles of investing in high-growth businesses with The Essentials of Snowball Investing.

2023 Financial Highlights: Strong Growth & Innovation

In 2023, Shopify reinforced its leadership in digital commerce with new product innovations and strong financial performance across key metrics. The company introduced Shopify Magic and Sidekick, AI-powered tools designed to streamline tasks and enhance customer interactions. It also expanded its mobile point-of-sale system (POS Go) and launched new initiatives, including Shop Cash rewards, Shopify Collective, Marketplace Connect, and Commerce Components. Additionally, over 100 new updates were introduced in the Winter '24 Edition, reinforcing Shopify’s commitment to continuous improvement.

Key Financial Metrics

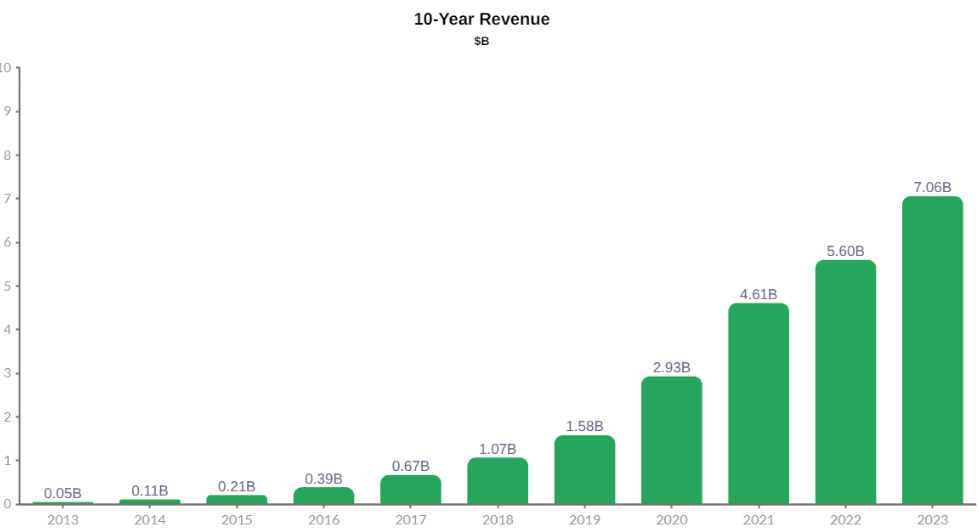

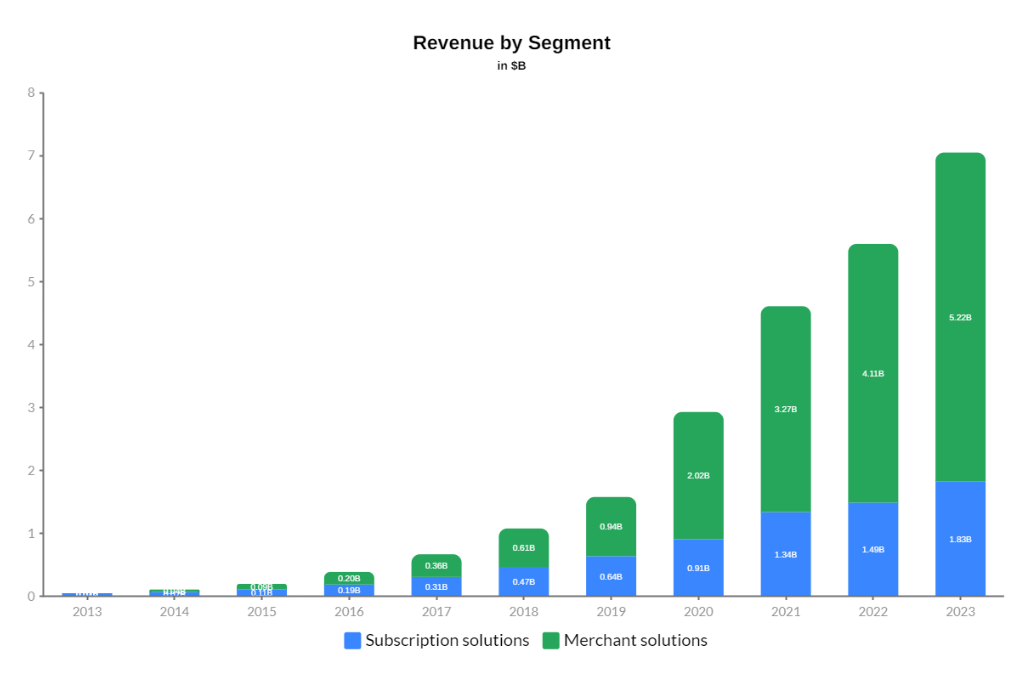

- Revenue Growth: Shopify's total revenue surged to $7.06 billion in 2023, marking a 26% year-over-year increase. This growth was fueled by a rise in new merchants and greater adoption of premium services like Shopify Plus.

- Revenue Composition: 74% of revenue came from subscription solutions, while 26% stemmed from merchant solutions, showcasing Shopify’s ability to attract and retain businesses with scalable, flexible offerings.

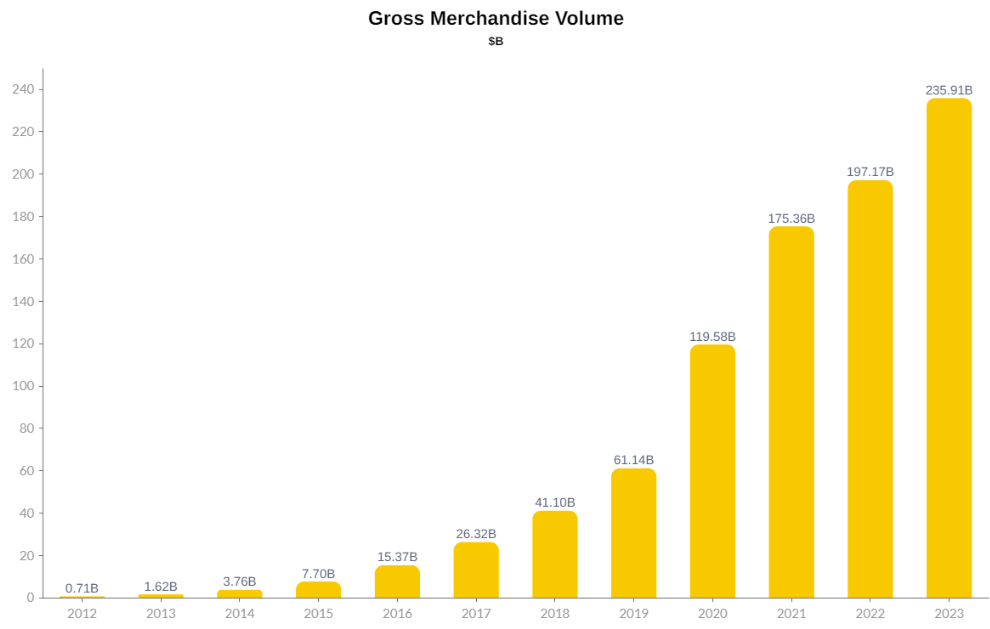

- Gross Merchandise Volume (GMV): Shopify’s GMV reached $235.91 billion, reflecting its growing influence in online commerce and the resilience of its merchant community.

- Gross Profit & Margins: Shopify’s gross profit climbed to $3.5 billion, with a margin exceeding 50%. While expansion into services like payments, shipping, and capital led to slight margin compression, these long-term investments strengthen Shopify’s competitive edge and merchant value.

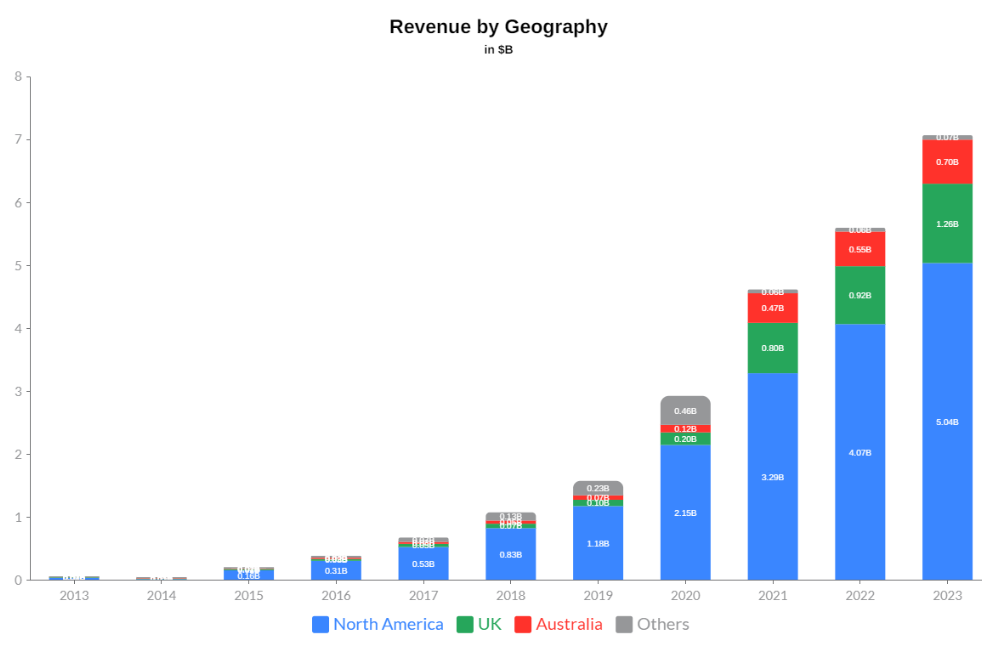

- Geographic Revenue Growth: North America led revenue generation at $5.04 billion, followed by strong contributions from the UK and Australia. Shopify’s global expansion continues to gain momentum, penetrating both mature and emerging markets.

For an in-depth understanding of market trends, check out Books on Investing.

Cash Flow & Profitability

- Operating Cash Flow: Shopify reported a record $944 million in operating cash flow, rebounding from a $136 million deficit in 2022. This recovery was driven by improved operational efficiency, platform expansion, and a stabilizing global economy.

- Net Income & Liquidity: Shopify’s net income rose to $132 million, marking a significant turnaround from 2022’s losses. With $5 billion in cash and securities, Shopify is well-positioned for continued growth and strategic investments in the evolving e-commerce landscape.

Shopify's Business Model: A Scalable & All-in-One E-Commerce Solution

Shopify operates on a subscription-based model, providing merchants with a powerful, flexible e-commerce platform tailored to businesses of all sizes. Whether for startups or enterprise-level companies, Shopify offers the tools needed to establish, manage, and scale online stores efficiently.

Comprehensive Tools & Merchant Flexibility

Shopify delivers a full suite of tools and services to support merchants in optimizing their online presence:

- Theme Store – A variety of customizable free and paid themes to align with brand identity.

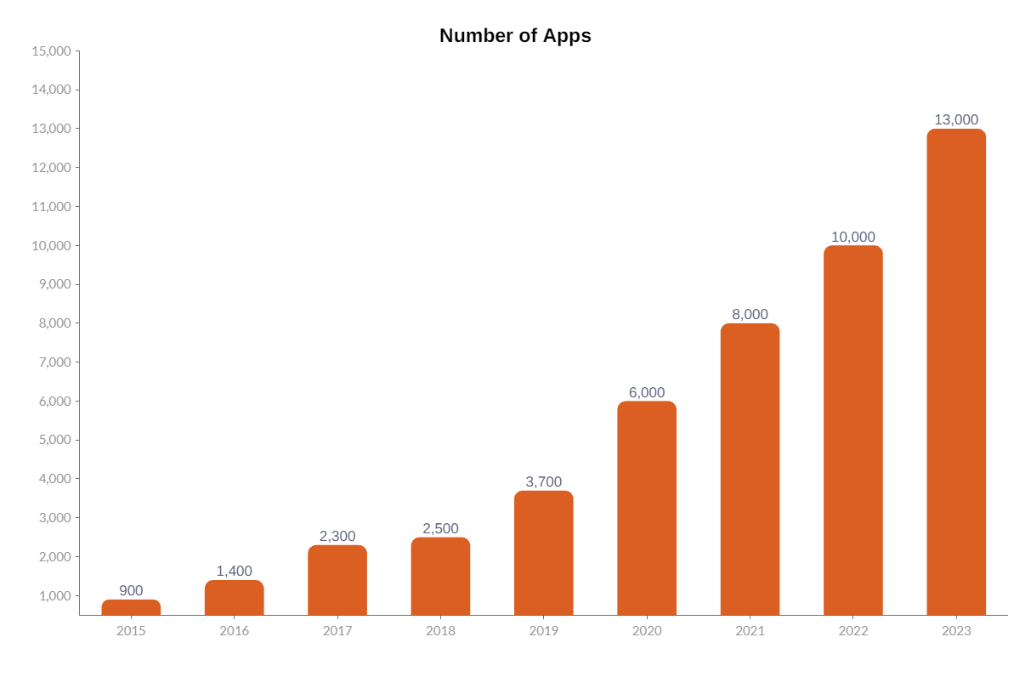

- App Store – Over 8,000 third-party apps enhancing store functionality, from marketing to inventory management.

- Integrated Payments – Shopify Payments enables seamless transactions without third-party fees.

- Multi-Channel Selling – Merchants can sell via social media, marketplaces, and physical retail using Shopify’s ecosystem.

- Enterprise-Grade Solutions – Shopify Plus provides scalability, automation, and cost-efficiency for high-growth businesses.

Shopify also offers 24/7 customer support and cloud-based hosting, ensuring smooth operations while merchants focus on business growth.

How Shopify Generates Revenue

Subscription Solutions

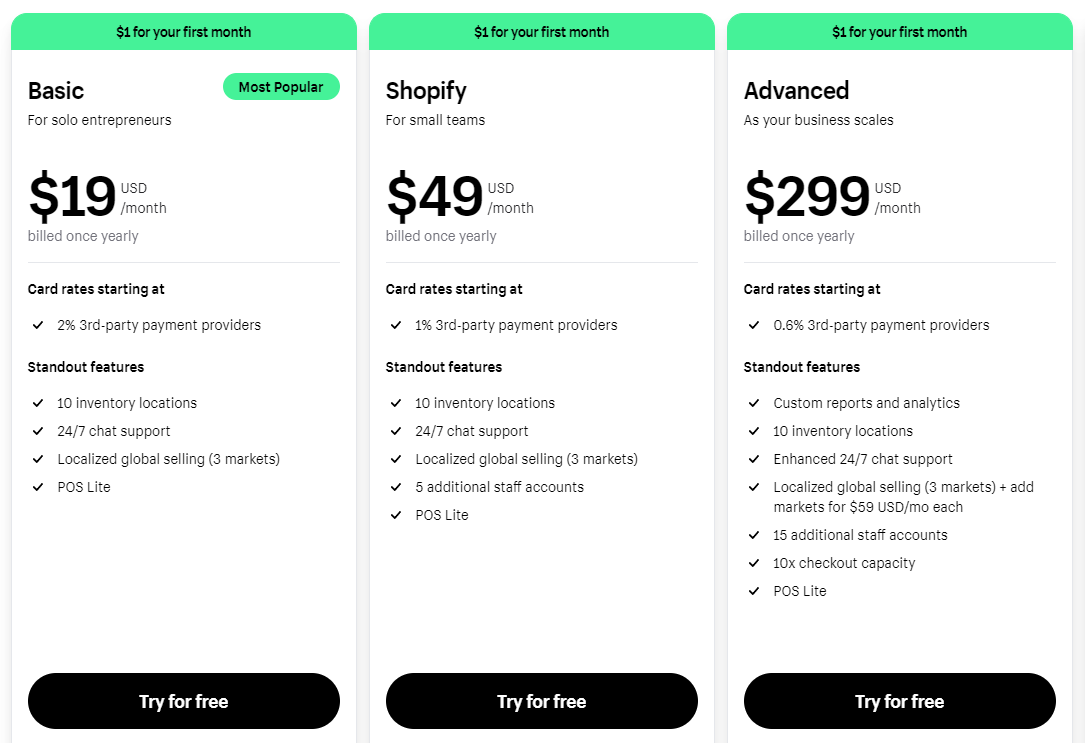

Shopify’s subscription plans empower merchants with tailored features:

- Basic Shopify – Essential tools including unlimited product listings, social media integrations, and 24/7 live chat support.

- Shopify Plan – Expanded features like five staff accounts, lower transaction fees, and API access for secure data handling.

- Advanced Shopify – Advanced reporting, third-party calculated shipping rates, and lower credit card fees for high-volume sellers.

Shopify Plus: Enterprise-Level E-Commerce

Designed for businesses with high sales volumes, Shopify Plus offers:

- Personalized Support & API Access – Customizable checkout experiences and seamless B2B process automation.

- Shop Pay & Shopify Flow – Advanced tools for faster transactions and streamlined workflows.

- Scalability & Performance – Handles large traffic surges with reliability and security.

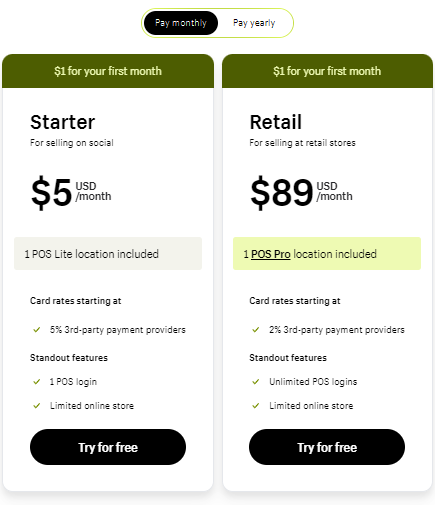

Shopify also provides specialized plans, such as:

- Shopify Starter – Ideal for small businesses and creators selling through social media.

- Retail Plan – Designed for brick-and-mortar stores, integrating seamlessly with Shopify POS.

- Enterprise Commerce – A robust B2B and B2C solution for companies needing advanced customization and multi-channel sales.

Merchant Solutions: Expanding Shopify’s Revenue Streams

Beyond subscriptions, Shopify generates revenue through merchant solutions, including:

Shopify Payments

- Integrated payment processing with competitive transaction rates.

- Supports multiple payment methods, including credit cards, digital wallets, and BNPL (Buy Now, Pay Later) options.

- Charges third-party transaction fees, adding to Shopify’s revenue.

Shopify Shipping

- Partners with DHL Express, UPS, and USPS to provide discounted rates up to 88%.

- Features automated routing, bulk label printing, and embedded shipping insurance for merchant convenience.

Shopify Capital

- Offers business financing up to $2 million with a simple application and fast approval process.

- Uses AI-driven risk assessment instead of traditional credit checks.

- Has invested over $5.1 billion in merchants, helping businesses grow without requiring equity.

Shopify’s Developer Ecosystem: Apps, Themes & Hardware

Shopify’s App & Theme Stores contribute to its financial success by supporting third-party developers and providing merchants with tailored solutions.

- App Store – Over 8,000 apps for analytics, marketing, inventory, and customer support.

- Theme Store – Pre-designed customizable storefronts, allowing developers to earn commissions.

- APIs & SDKs – Shopify’s developer-friendly ecosystem enables seamless integrations and innovation.

POS & Hardware Sales

Shopify’s Point-of-Sale (POS) solutions bridge the gap between e-commerce and physical retail:

- Offers POS hardware like card readers, barcode scanners, and receipt printers.

- Provides a unified sales dashboard, allowing merchants to manage online and offline transactions efficiently.

- Ensures 99.9% uptime, delivering a reliable omnichannel retail experience.

📌 Shopify Point-of-Sale (POS) systems integrate seamlessly with physical stores, enabling efficient sales and inventory tracking. Explore the best barcode scanners for Shopify POS.

📌 Need cash-handling solutions for your retail store? Check out Shopify’s recommended cash drawers.

Shopify: A Resilient & Scalable E-Commerce Powerhouse

With its diverse revenue streams, innovative merchant solutions, and scalable business model, Shopify continues to dominate the e-commerce landscape. Whether through subscriptions, merchant services, or its growing developer ecosystem, Shopify’s ability to adapt and innovate ensures its long-term success in digital commerce.

Market Opportunity: Shopify’s Role in a Booming E-Commerce Sector

The global e-commerce industry is on a rapid growth trajectory, projected to reach $6.3 trillion by 2024, fueled by AI innovations, mobile commerce expansion, and digital payment advancements. With 2.71 billion online purchases anticipated by 2025, the industry has grown from $1.84 trillion in 2016 to $5.78 trillion in 2023, with forecasts projecting $8.03 trillion by 2027.

Key Growth Drivers & Market Trends

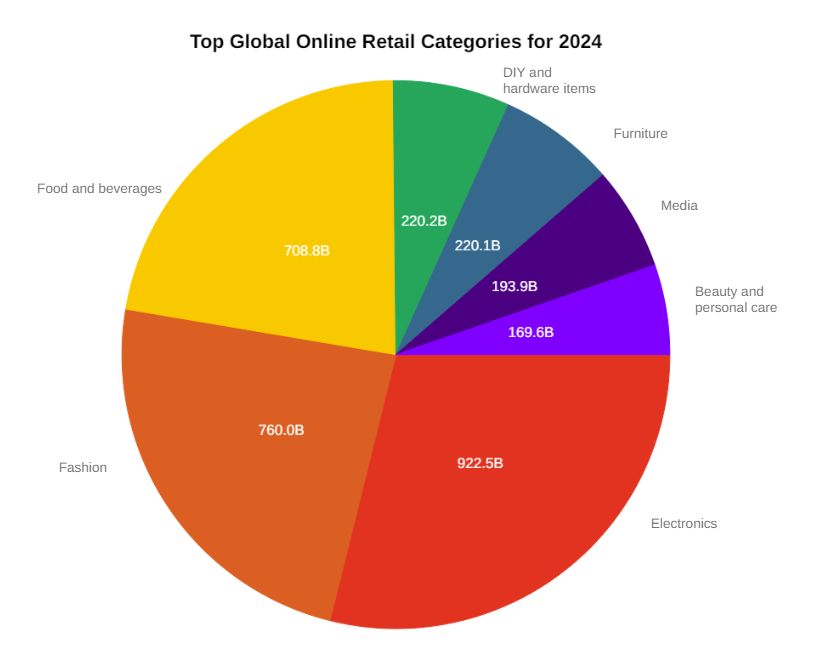

- Top-Selling E-Commerce Categories (2024):

- Electronics: $922.5 billion

- Fashion: $760 billion

- Food & Beverages: $708.8 billion

- U.S. E-Commerce Expansion:

- 34% of U.S. consumers shop online weekly, with 52% purchasing international products.

- Social commerce (Facebook, Instagram, and TikTok) is projected to reach $1.69 trillion by 2024 and $2.9 trillion by 2026, primarily driven by 18 to 34-year-olds.

- The U.S. e-commerce market has seen a 330% increase over the past decade, with Q1 2024 sales hitting $290 billion.

- By 2027, U.S. e-commerce sales are expected to reach $1.72 trillion, making up 22.6% of total retail sales.

Why Shopify Is Poised for Long-Term Growth

With 26.6 million active e-commerce sites globally, Shopify is well-positioned to capture market share as digital retail expands. The platform's comprehensive merchant solutions, seamless integrations, and AI-driven commerce tools provide an advantage in a highly competitive space.

As e-commerce accelerates, Shopify’s investments in multi-channel selling, AI-powered automation, and payment solutions will further strengthen its role in the evolving digital economy.

Want to refine your investment strategy? Explore The Essentials of Snowball Investing for deep insights.

Strategic Initiatives: Strengthening Shopify’s Market Leadership

Shopify has cemented itself as a dominant force in e-commerce by investing in subscription and merchant solutions, fueling significant revenue growth and expanding its global presence.

Subscription Solutions: The Foundation of Shopify’s Business Model

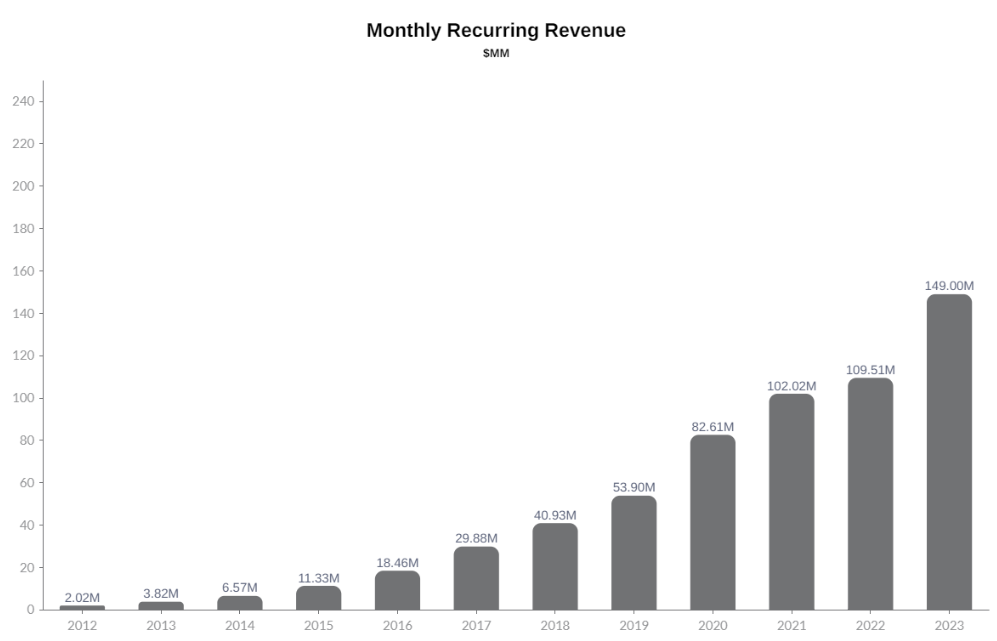

Shopify’s subscription solutions provide merchants with scalable tools for online store creation, hosting, and analytics. Since 2014, this segment has been a key driver of revenue, boasting a compound annual growth rate (CAGR) of over 50%.

Key Milestones in Subscription Growth

- 2014-2015: Launch of Shopify Plus, targeting high-GMV merchants and increasing average revenue per user (ARPU).

- 2018: Expansion of multi-currency support, country-specific domains, and mobile optimizations, enhancing global accessibility.

- 2021: Shopify Plus attracts enterprise-level merchants, contributing to long-term revenue expansion.

Merchant Solutions: Driving Ecosystem Growth

Shopify’s merchant solutions—including Shopify Payments, Shipping, and Capital—have become major revenue streams.

Key Developments in Merchant Solutions

- 2016-2017: Investments in vendor relationships and integrated payment processing to enhance platform capabilities.

- 2019: Launch of Shopify Fulfillment Network (SFN) to provide fast and cost-effective merchant fulfillment.

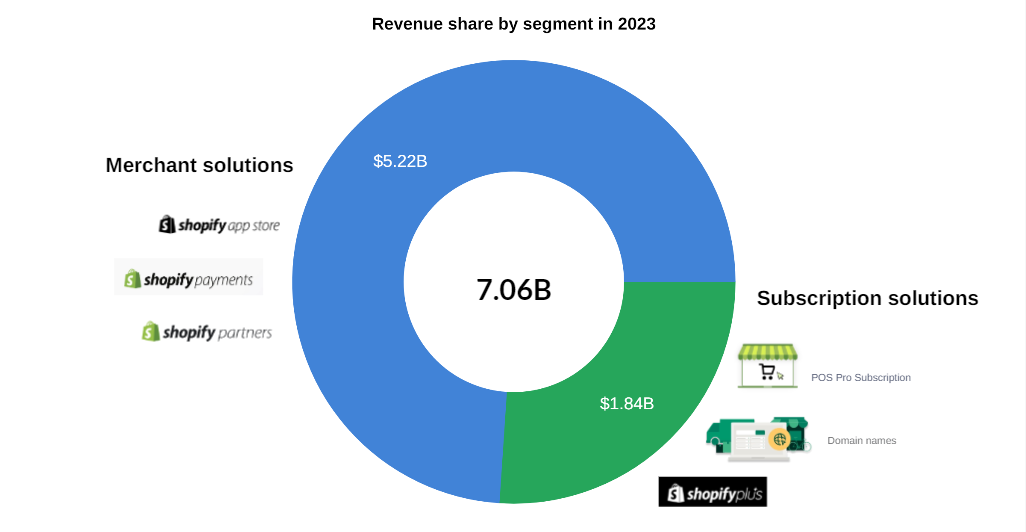

- 2023: Merchant solutions surpass subscription revenue, contributing over $5.22 billion in revenue.

Revenue Breakdown by Segment (2023)

- Subscription Solutions: $1.84 billion, fueled by continued platform enhancements and an expanding merchant base.

- Merchant Solutions: $5.22 billion, driven by increased merchant engagement and adoption of integrated services.

Cohort-Driven Revenue Trends: Shopify’s Evolution (2018-2023)

2018: Scaling Shopify Plus & Merchant Engagement

- Enhanced Shopify Plus capabilities with advanced customization and analytics, attracting high-GMV businesses.

- Launch of Shopify Ping, improving merchant-customer interactions.

2019: Fulfillment & Omnichannel Expansion

- Shopify Fulfillment Network (SFN) launched, providing faster shipping and logistics solutions.

- Shopify POS upgrades supported omnichannel selling, increasing merchant adoption.

2020: Adapting to Market Challenges

- Introduced free trials and reduced fees to support businesses during COVID-19.

- Shopify Balance launched, improving financial services for merchants.

2021-2023: Expansion & AI-Driven Growth

- Shopify Markets (2021): Enabled global merchant expansion, driving higher margins.

- Shopify Audiences (2022): Data-driven tools boosted GMV and retention.

- Shopify Credit & AI-powered tools (2023): Strengthened B2B offerings and enhanced merchant automation.

Global Expansion & Strategic Partnerships

Shopify’s strategic alliances with Facebook and Walmart have expanded its market reach, reinforcing its global e-commerce dominance.

Innovative Product Development

Shopify continues to revolutionize merchant and consumer experiences through:

- AI & Machine Learning – Enhancing predictive analytics and customer personalization.

- SFN Logistics Solutions – Offering fast, cost-effective inventory and fulfillment management.

- Augmented Reality (AR) – Empowering shoppers with interactive product visualization.

- SEO & Marketing Tools – Including Shopify Email & Blogging CMS to increase brand visibility.

Retail & Multi-Channel Selling

Shopify provides merchants with flexible sales channels:

- Shopify POS – Integrating online and in-store transactions for seamless retail management.

- Social Commerce Integration – Selling via Facebook, Instagram, TikTok, Amazon, Walmart, and Pinterest.

- Omnichannel Sales Support – Empowering merchants to sell beyond traditional storefronts.

Shopify’s strategic partnership with Walmart has expanded its reach, enabling merchants to access millions of customers through Walmart’s marketplace. Learn more about this partnership.

Shopify’s Competitive Edge in E-Commerce

By continuously expanding its ecosystem, investing in merchant solutions, and leveraging AI-driven tools, Shopify remains at the forefront of digital commerce innovation. Its strategic initiatives ensure long-term growth, deeper merchant engagement, and global scalability in an ever-evolving e-commerce landscape.

Competitive Landscape and Industry Dynamics

Shopify continues to outperform competitors by offering cutting-edge solutions, seamless integrations, and high-converting e-commerce tools that empower merchants to scale efficiently.

Driving Higher Revenue and Conversions

Shopify ensures industry-leading conversion rates through:

- Optimized Checkout Experience – One-click checkout, mobile responsiveness, and abandoned cart recovery.

- AI-Powered Personalization – Smart recommendations and automated marketing to improve sales.

- Shop App Expansion – Providing personalized mobile shopping experiences for millions of users.

- Custom Domains & Themes – Enhancing branding and website performance.

Success Story: Crossrope saw a 24% increase in conversion rates after switching to Shopify, highlighting its impact on merchant success.

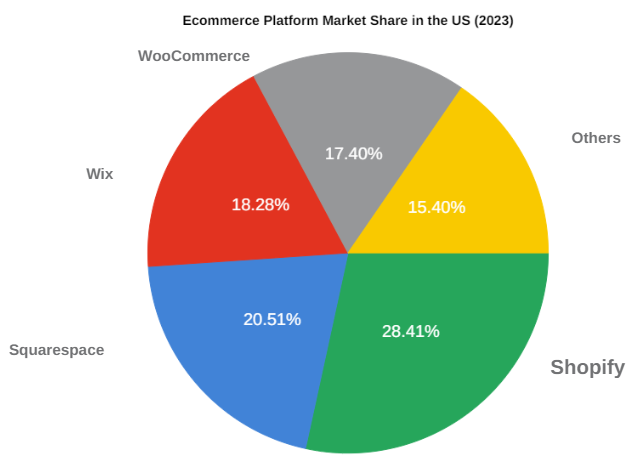

Market Position and Key Competitors

Market Share Insights

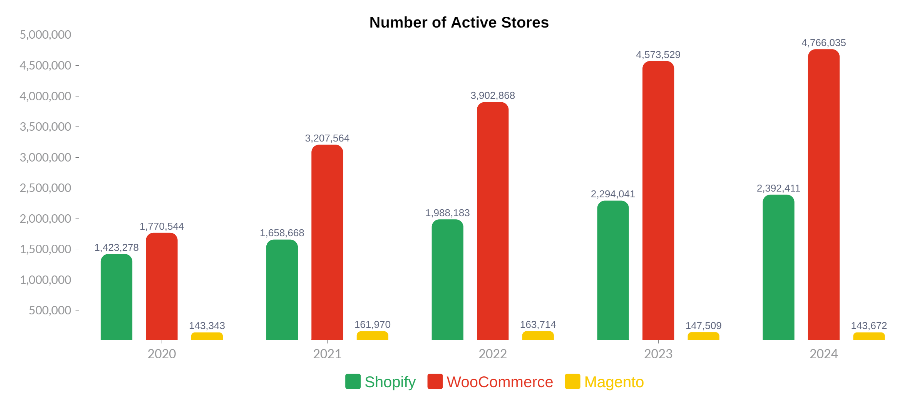

- Shopify held a 28.41% market share in 2023, outperforming Squarespace, Wix, and WooCommerce.

- Shopify supported over 1.7 million businesses and processed $812 billion in sales.

- While WooCommerce led globally at 38.74%, Shopify’s merchant-first model and infrastructure investments keep it competitive.

Competitive Edge: Shopify vs. Other E-Commerce Platforms

Shopify holds a 28.41% market share in the U.S. and 10.32% globally, positioning itself as a leading all-in-one e-commerce solution. Its key strengths include AI-driven automation, global scalability, and high conversion rates, making it a preferred choice for businesses looking for an easy-to-use, comprehensive platform. However, Shopify’s higher fees compared to open-source alternatives can be a drawback for cost-conscious merchants.

WooCommerce dominates the global market with a 38.74% share, largely due to its open-source flexibility and strong SEO capabilities. Businesses using WooCommerce benefit from customization and WordPress integration, but they face challenges such as third-party hosting requirements, complex setup, and security concerns, making it less ideal for those seeking a fully managed solution.

Magento, with a 7.91% global market share, is known for its highly customizable and enterprise-grade solutions. It is a preferred platform for large businesses that need complete control over their store’s design, functionality, and scalability. However, Magento comes with high development costs and requires significant technical expertise, making it less accessible for smaller merchants or those without a dedicated IT team.

Squarespace and Wix together account for 14.67% of the global e-commerce market and are widely recognized for their user-friendly design and ease of use, making them attractive to small businesses and creative professionals. While these platforms excel in simplicity and aesthetic design, they lack scalability and advanced e-commerce functionalities, often requiring businesses to migrate to more powerful platforms like Shopify or BigCommerce as they expand.

Ultimately, Shopify’s comprehensive ecosystem, AI-powered tools, and scalability give it a strong competitive edge over other platforms, making it a top choice for businesses looking to grow in an evolving e-commerce landscape.

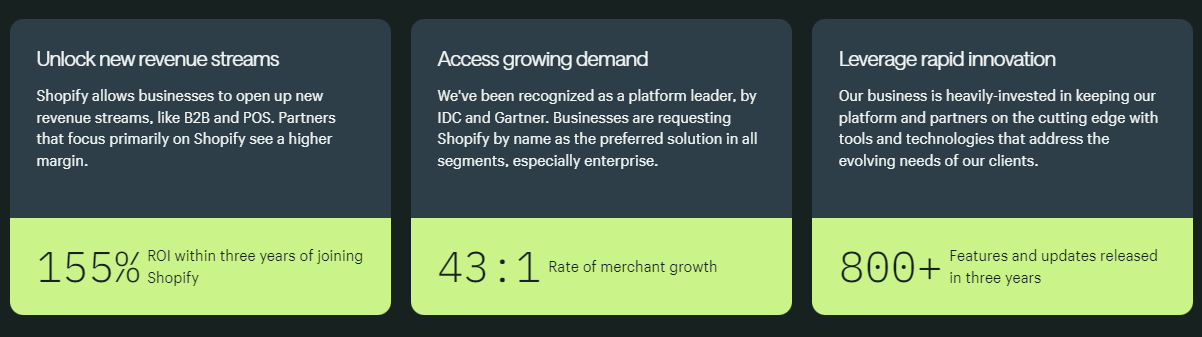

Why Shopify Stands Out

Lower Total Cost of Ownership

- 36% lower costs than competitors due to fewer third-party plugins and lower setup expenses.

- Built-in payment processing, fraud protection, and fulfillment options reduce reliance on external services.

Superior App & Theme Ecosystem

- Over 13,000 apps vs. 1,000+ on BigCommerce and 50 e-commerce templates on Squarespace.

- Extensive developer network enhances store functionality, marketing, and analytics.

Optimized Speed & Performance

- Built-in image compression and store speed reporting improve SEO rankings and user experience.

- 24/7 customer support and an ecosystem of educational resources ensure merchant success.

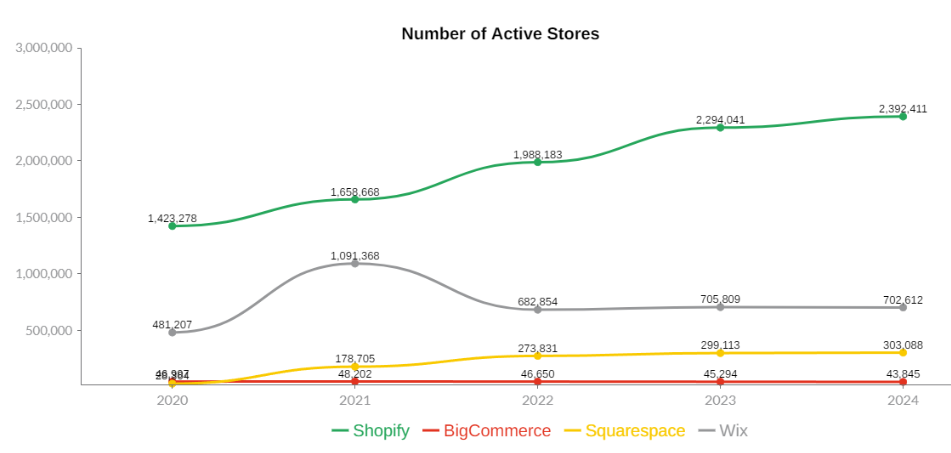

Shopify’s Growth in Active Stores

Shopify’s active store count rose from 1.42 million in 2020 to 2.39 million in 2024, outpacing competitors like Wix, BigCommerce, and Squarespace.

🔹 Why This Matters: Shopify’s sustained growth highlights its ability to attract and retain a diverse range of businesses, solidifying its position as an industry leader.

Superior Innovation & Global Reach

Scalability & Global Expansion

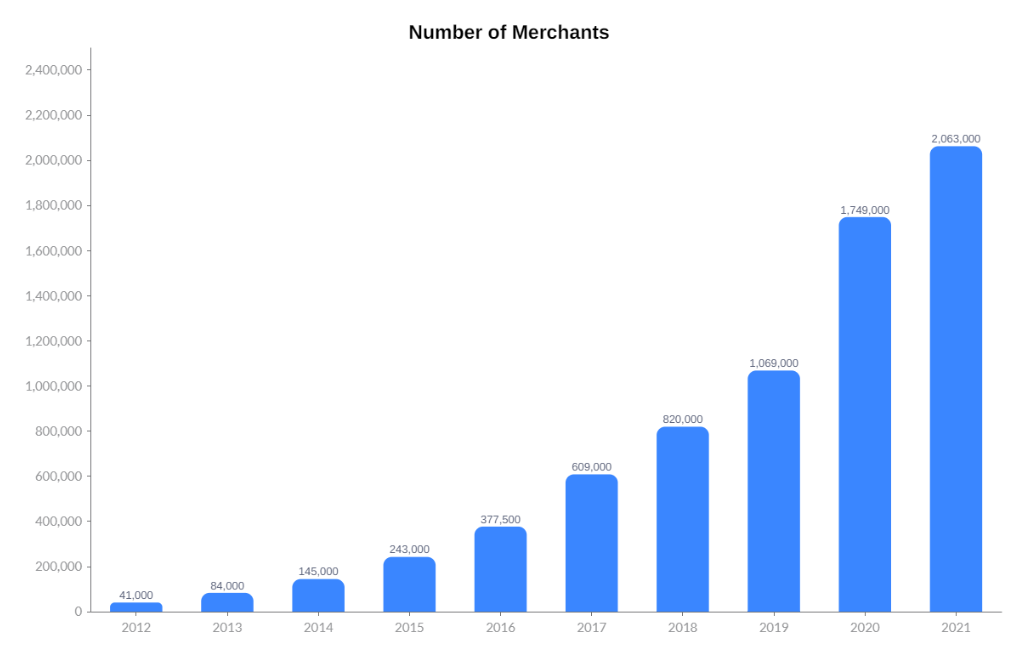

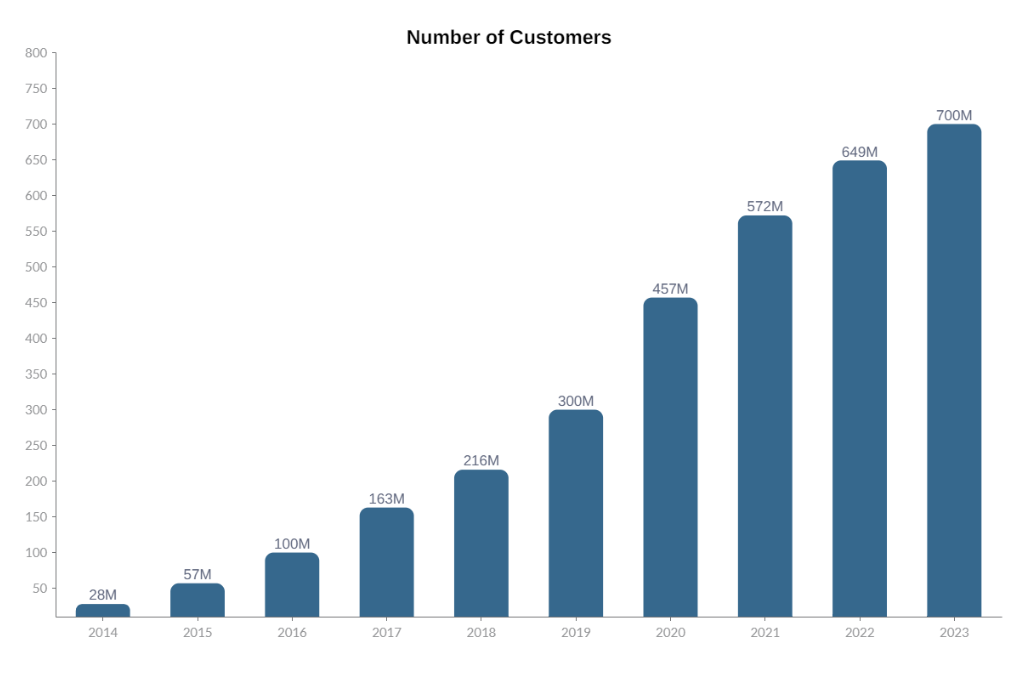

- Shopify’s user base grew from 28 million to 700 million between 2014 and 2023.

- Supports 1.7M+ businesses, offering solutions for startups to enterprise-level merchants.

AI & Machine Learning Innovations

- Shopify Markets & Shopify Audiences leverage AI for personalized marketing and international expansion.

- Shopify Fulfillment Network (SFN) ensures fast and cost-effective logistics.

- Augmented Reality (AR) enhances the shopping experience, increasing engagement and conversions.

Retail & Omnichannel Selling

- Shopify POS system integrates brick-and-mortar and online transactions.

- Seamless selling across Facebook, Instagram, TikTok, Amazon, Walmart, and more.

Success Story: Brands like Allbirds, Gymshark, and Kylie Cosmetics scaled globally using Shopify.

Shopify vs. WooCommerce vs. Magento: In-Depth Comparison

Ease of Use & Store Setup

✔ Shopify: Drag-and-drop store builder with built-in hosting, security, and payment processing.

✔ WooCommerce: Flexible but requires hosting, security, and third-party plugin management.

✔ Magento: Highly customizable but needs advanced technical knowledge and high development costs.

Feature Comparison: Shopify vs. WooCommerce vs. Magento

Shopify stands out as a fully managed e-commerce platform with built-in hosting and security, ensuring that merchants don’t need to worry about third-party services for website protection or performance. In contrast, WooCommerce and Magento require separate hosting solutions, increasing complexity and operational costs for users.

One of Shopify’s strongest advantages is its 24/7 customer support, offering merchants round-the-clock assistance for technical and operational issues. WooCommerce and Magento lack dedicated 24/7 customer support, requiring users to rely on community forums or external developers for troubleshooting.

In terms of mobile optimization, all three platforms—Shopify, WooCommerce, and Magento—offer responsive designs and mobile-friendly experiences, ensuring that online stores perform well across different devices.

However, Shopify leads in omnichannel selling, enabling seamless integration across social media platforms, online marketplaces, and physical retail locations. Magento also supports omnichannel commerce, but WooCommerce has limited built-in capabilities, requiring additional plugins for similar functionality.

A key differentiator for Shopify is its AI and machine learning tools, which enhance customer personalization, automate marketing campaigns, and optimize sales performance. Neither WooCommerce nor Magento have built-in AI capabilities, requiring third-party extensions for advanced automation.

Additionally, Shopify provides integrated payment processing through Shopify Payments, streamlining transactions and reducing dependency on external payment gateways. Both WooCommerce and Magento lack built-in payment processing, requiring merchants to integrate with third-party payment providers, which can result in additional transaction fees and setup complexity.

Overall, Shopify’s comprehensive feature set, including hosting, security, AI-driven automation, and integrated payments, makes it the most user-friendly and scalable solution compared to WooCommerce and Magento, especially for businesses looking for a hassle-free e-commerce experience.

Market Trends: Active Stores Growth (2020-2024)

WooCommerce leads in active stores, surpassing 4 million due to its affordability and integration with WordPress.

Shopify’s rapid growth from 1.42M (2020) to 2.39M (2024) indicates strong adoption among high-growth businesses.

Magento’s niche appeal remains stable, catering to large enterprises needing advanced customization.

📌 Global e-commerce sales continue to grow, with Shopify well-positioned to capture market share. Read more on global e-commerce sales trends.

📌 E-commerce is evolving rapidly. Explore key industry statistics to understand where Shopify fits in the larger digital commerce landscape.

Platform Popularity & Market Presence

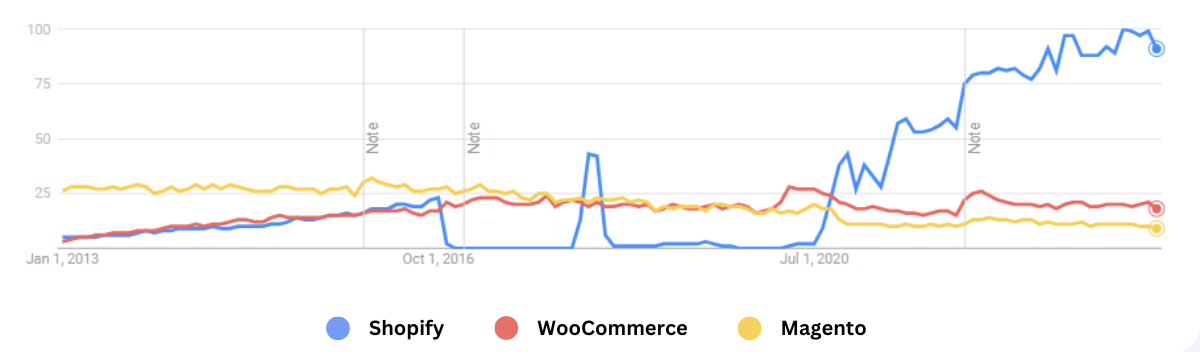

Google Trends Analysis (2013-2023):

- Shopify surged in popularity post-2016, peaking in 2021, and has remained dominant.

- WooCommerce maintains steady interest, reflecting strong WordPress integration.

- Magento declined after 2016, indicating a shift toward easier-to-use platforms like Shopify.

📌 Explore how Shopify stacks up against its top competitors—BigCommerce, WooCommerce, and Salesforce Commerce Cloud—by visiting these in-depth comparisons:

- BigCommerce vs. Shopify: Compare features, pricing, and scalability

- Another BigCommerce vs. Shopify comparison: Explore the best fit for your business

- A deeper analysis of BigCommerce vs. Shopify: Check out this detailed breakdown

- Salesforce Commerce Cloud vs. Shopify: Which platform is better for your business?

- Migrating from Shopify Plus to Salesforce Commerce Cloud? Here's what to consider

Shopify holds a significant market share, but how does WooCommerce compare? Check the latest market statistics.

Why Businesses Choose Shopify Over Competitors

1️. All-in-One Solution – Shopify provides built-in security, hosting, payment processing, and fulfillment.

2️. Superior Scalability – Businesses can start small and scale to enterprise-level operations with Shopify Plus.

3️. AI-Driven Growth – Shopify’s machine learning tools, automation, and advanced analytics help merchants optimize performance.

4️. Multi-Channel Selling – Seamless integrations with social media, marketplaces, and retail POS systems.

5️. Strong Ecosystem – Over 13,000 apps and robust developer support ensure flexibility.

Shopify’s continuous innovation, scalable solutions, and AI-powered tools make it the top choice for businesses looking to grow in a competitive e-commerce landscape.

Risks and Challenges: Navigating Shopify’s Path to Sustained Growth

While Shopify has achieved remarkable growth and market leadership, the company faces several challenges that could impact its long-term success. These risks stem from increasing competition, economic fluctuations, operational scalability, regulatory complexities, and cybersecurity threats.

Competitive Pressures in a Crowded Market

Shopify competes with e-commerce giants like Amazon and emerging platforms that continue to expand their offerings. This growing competition could limit Shopify’s ability to maintain its market share, particularly in saturated regions like North America and Western Europe.

To stay ahead, Shopify is investing in AI-driven commerce tools, expanding omnichannel capabilities, and enhancing merchant services. The company is also forming strategic partnerships and localizing its platform to strengthen its position in Asia and Latin America, where e-commerce growth is accelerating.

Macroeconomic Risks and Merchant Turnover

During economic downturns, consumer spending declines, which directly impacts Shopify’s merchant base—primarily small businesses and entrepreneurs. Many merchants may reduce services, downgrade plans, or exit the platform entirely, leading to increased customer turnover and lower subscription revenue.

To counteract this, Shopify is diversifying its revenue streams, investing in Shopify Payments, Shopify Capital, and POS solutions to support merchants across both online and offline channels. Additionally, the company is expanding its financial services and credit offerings, helping businesses stay afloat during economic fluctuations.

Operational Challenges & Scalability Risks

As Shopify continues to scale, expanding its infrastructure to handle rising transaction volumes and merchant growth is critical. Failure to do so could result in:

- Service disruptions leading to merchant dissatisfaction.

- Increased downtime, affecting Shopify’s reliability.

- Reputational damage from scalability issues.

Furthermore, Shopify’s logistics and fulfillment services, including the Shopify Fulfillment Network (SFN), introduce additional complexity. Supply chain disruptions, inventory mismanagement, and rising fulfillment costs could create operational inefficiencies.

To address these challenges, Shopify is investing in cloud-based scalability solutions, AI-powered automation, and predictive analytics to enhance platform stability and merchant experience.

Regulatory & Compliance Risks

Operating in multiple regions means Shopify must navigate complex regulatory frameworks related to:

- Taxation & trade restrictions across international markets.

- Consumer protection laws affecting merchant operations.

- Liability for counterfeit or restricted products sold on its platform.

To mitigate these risks, Shopify is enhancing compliance measures, implementing automated fraud detection, and collaborating with global regulatory bodies to ensure adherence to changing legal requirements.

Cybersecurity & Data Protection

As a platform hosting millions of businesses and processing billions in transactions, Shopify is a prime target for cyber threats, fraud, and data breaches. A security lapse could lead to:

- Loss of customer trust and reputational damage.

- Regulatory penalties for non-compliance with data protection laws.

- Financial losses from fraud or hacking incidents.

To strengthen cybersecurity, Shopify is investing heavily in AI-driven fraud detection, advanced encryption protocols, and multi-layered authentication systems. The company is also prioritizing merchant education on security best practices, reinforcing trust within its ecosystem.

Shopify’s Strategic Approach to Risk Management

Despite these challenges, Shopify remains well-positioned to maintain its leadership in the evolving e-commerce landscape. The company is actively:

✔ Expanding into offline retail through POS integrations and in-store commerce solutions.

✔ Leveraging AI and machine learning to drive automation, efficiency, and fraud prevention.

✔ Enhancing cybersecurity infrastructure to protect merchant data and transactions.

✔ Diversifying revenue streams beyond subscriptions to mitigate economic risks.

With proactive risk management, continuous innovation, and a global expansion strategy, Shopify is focused on sustaining long-term growth and retaining its position as a top e-commerce platform.

Shopify’s Leadership: Driving Innovation & Global Expansion

Shopify’s leadership team is at the core of its innovation, strategic expansion, and global success. Through visionary direction, financial discipline, and market foresight, these leaders continue to position Shopify as a dominant force in e-commerce.

Executive Leadership: Powering Shopify’s Growth

Tobi Lütke – Founder & Chief Executive Officer

Under Lütke’s leadership, Shopify has transformed from a small e-commerce platform into a global marketplace serving millions of businesses. His commitment to AI-driven commerce, headless commerce solutions, and customer-first innovation ensures Shopify stays ahead of industry trends. Lütke’s tech-forward mindset keeps Shopify at the forefront of digital retail transformation.

Harley Finkelstein – President

Finkelstein’s expertise in strategic partnerships, branding, and high-impact marketing has expanded Shopify’s market reach and brand dominance. His ability to anticipate market trends has played a crucial role in Shopify’s sustained growth and industry leadership, making the platform the go-to choice for entrepreneurs and established brands alike.

Jeff Hoffmeister – Chief Financial Officer

As CFO, Hoffmeister has strengthened Shopify’s financial structure, ensuring sustainable growth through R&D investments, acquisitions, and international expansion. His risk management strategies have safeguarded Shopify’s balance sheet, allowing the company to navigate economic fluctuations while maintaining financial resilience. His foresight in capital planning ensures Shopify remains a leader in digital commerce.

Key Stakeholders & Governance

John H. Phillips – Influential Investor & Board Member

Phillips has played a pivotal role in Shopify’s expansion by providing strategic direction and governance. His leadership has guided the company through critical growth phases, helping Shopify seize market opportunities and overcome industry challenges.

Strategic Board of Directors

Shopify’s Board of Directors consists of seasoned executives Robert Ashe, Gail Goodman, Colleen Johnston, Jeremy Levine, and Prashanth Mahendra-Rajah, who provide strategic oversight and corporate governance. Their diverse expertise supports Shopify in:

- Exploring new markets and international expansion

- Navigating regulatory challenges across different regions

- Maximizing long-term shareholder value

With strong leadership, financial acumen, and an innovation-driven culture, Shopify’s executive team ensures the company remains at the forefront of global e-commerce, delivering long-term success for merchants and investors alike.

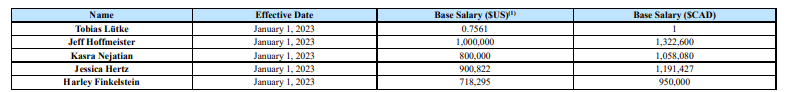

Executive Compensation: Aligning Leadership with Long-Term Growth

Shopify’s executive compensation strategy is designed to align leadership incentives with shareholder value, fostering a culture of long-term success and sustainable growth. By emphasizing stock and option-based rewards, Shopify ensures that its senior executives remain deeply invested in the company’s future performance.

Stock-Based Compensation for Leadership

In 2023, CEO Tobi Lütke received a $20 million compensation package, predominantly in stock options, reinforcing his commitment to Shopify’s success. Remarkably, for the fourth consecutive year, Lütke chose to receive a symbolic base salary of CAD $1, demonstrating his confidence in Shopify’s long-term trajectory. His earnings only increase if the company performs well, aligning his financial success with that of shareholders.

By structuring executive pay in this way, Shopify ensures that its leadership faces the same financial risks and rewards as investors, fostering accountability and driving strategic innovation.

Flex Comp: A Revolutionary Compensation Model

To provide greater flexibility in executive compensation, Shopify introduced Flex Comp, a customizable pay structure that allows executives and employees to personalize their compensation mix. Under this model, leaders can choose how they receive their earnings, adjusting the balance between cash, stock options, and restricted stock units (RSUs) based on their preferences and risk tolerance.

This innovative system not only attracts top-tier talent but also encourages long-term investment in Shopify’s success. By tying a significant portion of executive pay to the company’s stock performance, Shopify reinforces its leadership’s commitment to sustained growth, innovation, and shareholder value.

A Performance-Driven Leadership Philosophy

Shopify’s approach to executive compensation underscores its broader philosophy—building a leadership team that is financially and strategically invested in the company’s future. By structuring compensation around performance-based incentives and stock appreciation, Shopify ensures that its executives remain focused on driving growth, scaling innovation, and creating long-term value for both the company and its shareholders.

Shopify CEO Tobias Lütke’s compensation reflects performance-based incentives, ensuring his financial interests align with shareholders. See how Shopify’s executive pay compares to other Canadian tech CEOs.

Future Outlook and Investment Opportunity: Shopify’s Path to Sustained Growth

Shopify is poised for continued expansion, driven by strong revenue growth, a growing merchant base, and strategic global initiatives. By focusing on platform innovation, omnichannel commerce, and AI-powered tools, Shopify aims to solidify its leadership in the e-commerce space while maximizing value for merchants and investors.

Key Growth Drivers & Strategic Expansion

1️. Global Expansion & Market Penetration

Shopify is aggressively expanding into international markets, tailoring its platform to regional needs, local payment methods, and regulatory environments. This strategy ensures greater adoption in high-growth regions like Asia and Latin America, where e-commerce demand is surging.

2️. AI & Automation Enhancements

Shopify is investing heavily in AI-driven tools, enabling merchants to:

✔ Automate store management and customer support.

✔ Enhance personalized recommendations to increase conversions.

✔ Improve demand forecasting and inventory management through machine learning.

3️. Payment & Logistics Innovations

To streamline transactions and fulfillment, Shopify is enhancing:

✔ Shopify Payments for faster and more secure transactions.

✔ Shopify Fulfillment Network (SFN) to reduce shipping times and optimize logistics.

✔ Buy Now, Pay Later (BNPL) options to drive higher conversion rates.

4️. Strengthening Omnichannel Commerce

Shopify is capitalizing on mobile commerce, social commerce, and direct-to-consumer (DTC) trends by:

✔ Expanding social media integrations (TikTok, Instagram, Facebook).

✔ Strengthening Shopify POS solutions for seamless in-store and online shopping.

✔ Enhancing one-click checkout experiences to reduce cart abandonment.

Investment Potential: A Strong Case for Growth

Financial Strength & GMV Growth:

Shopify’s Gross Merchandise Volume (GMV) continues to rise, reflecting merchant confidence and platform scalability. Its steady revenue growth and diversified income streams make it an attractive choice for investors seeking exposure to the booming e-commerce sector.

Resilience Amid Challenges:

Despite facing market competition, operational hurdles, and regulatory risks, Shopify maintains financial stability, strategic adaptability, and technological leadership—key factors in sustaining long-term investor confidence.

Considering an investment in Shopify? Understanding the broader e-commerce landscape is crucial. Check out key software statistics to evaluate Shopify’s market position.

Final Outlook: A Promising Future in E-Commerce

As e-commerce evolves, Shopify remains well-positioned to lead the industry by:

✔ Driving innovation through AI and automation.

✔ Expanding its global footprint with localized solutions.

✔ Enhancing omnichannel experiences for merchants and consumers.

With a solid financial foundation, a forward-thinking leadership team, and continuous technological advancements, Shopify is set to sustain market leadership and deliver long-term value for investors and merchants alike.

📖 Want to deepen your understanding of investing in high-growth companies like Shopify? Start here:

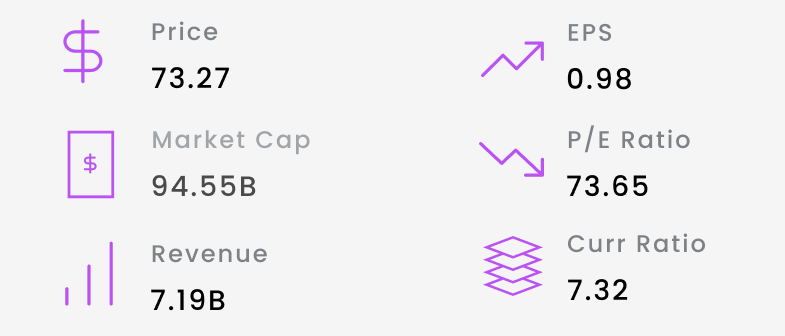

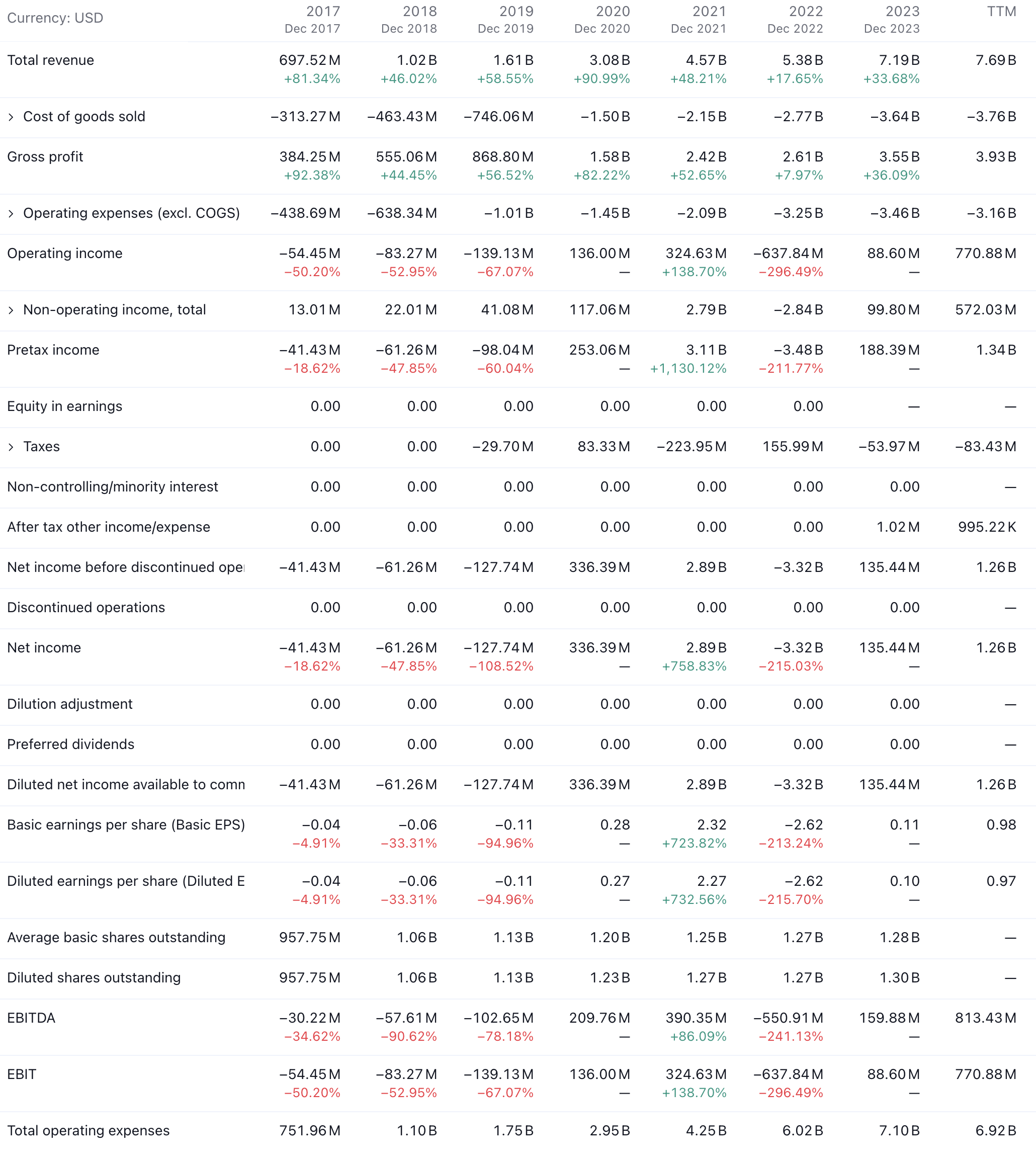

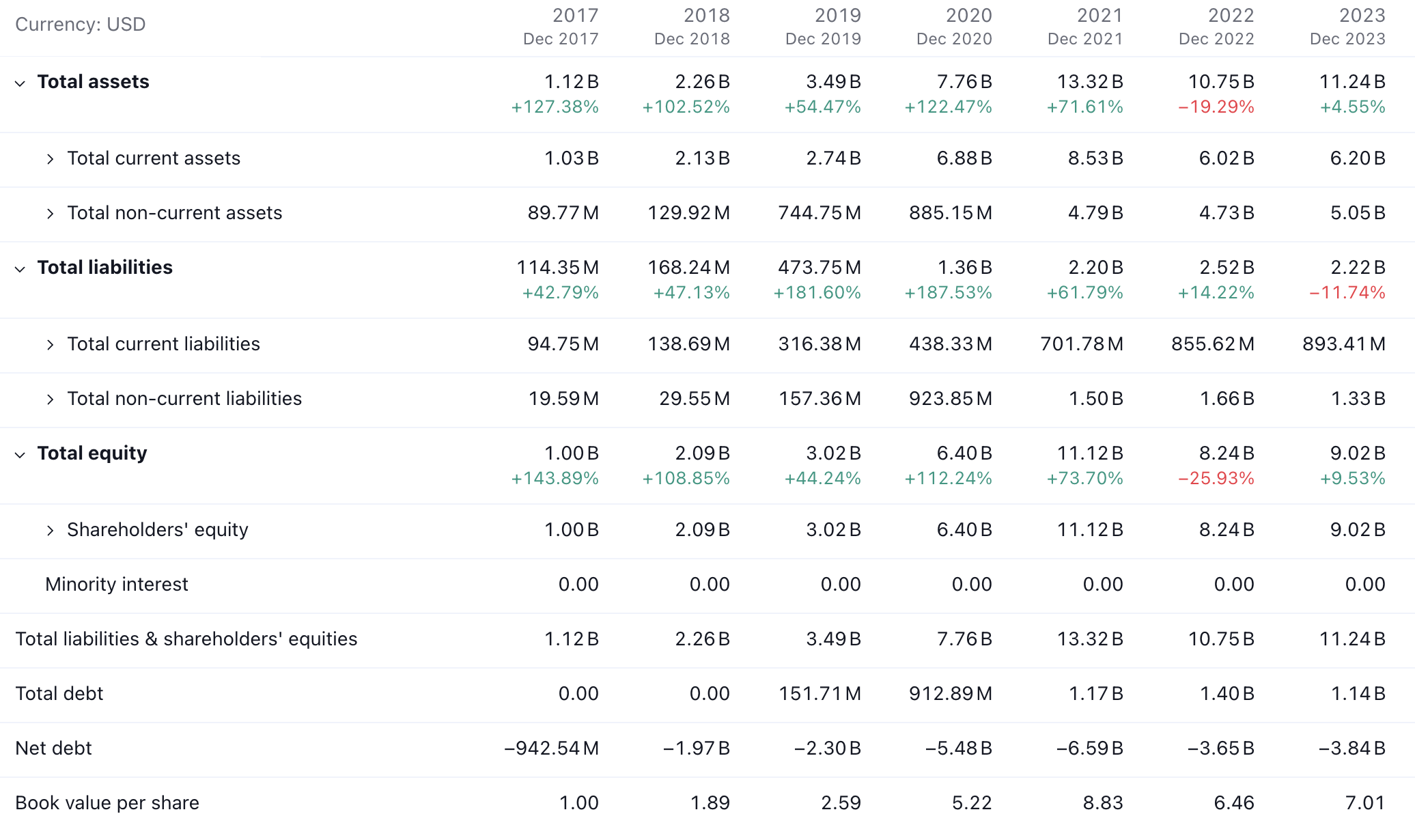

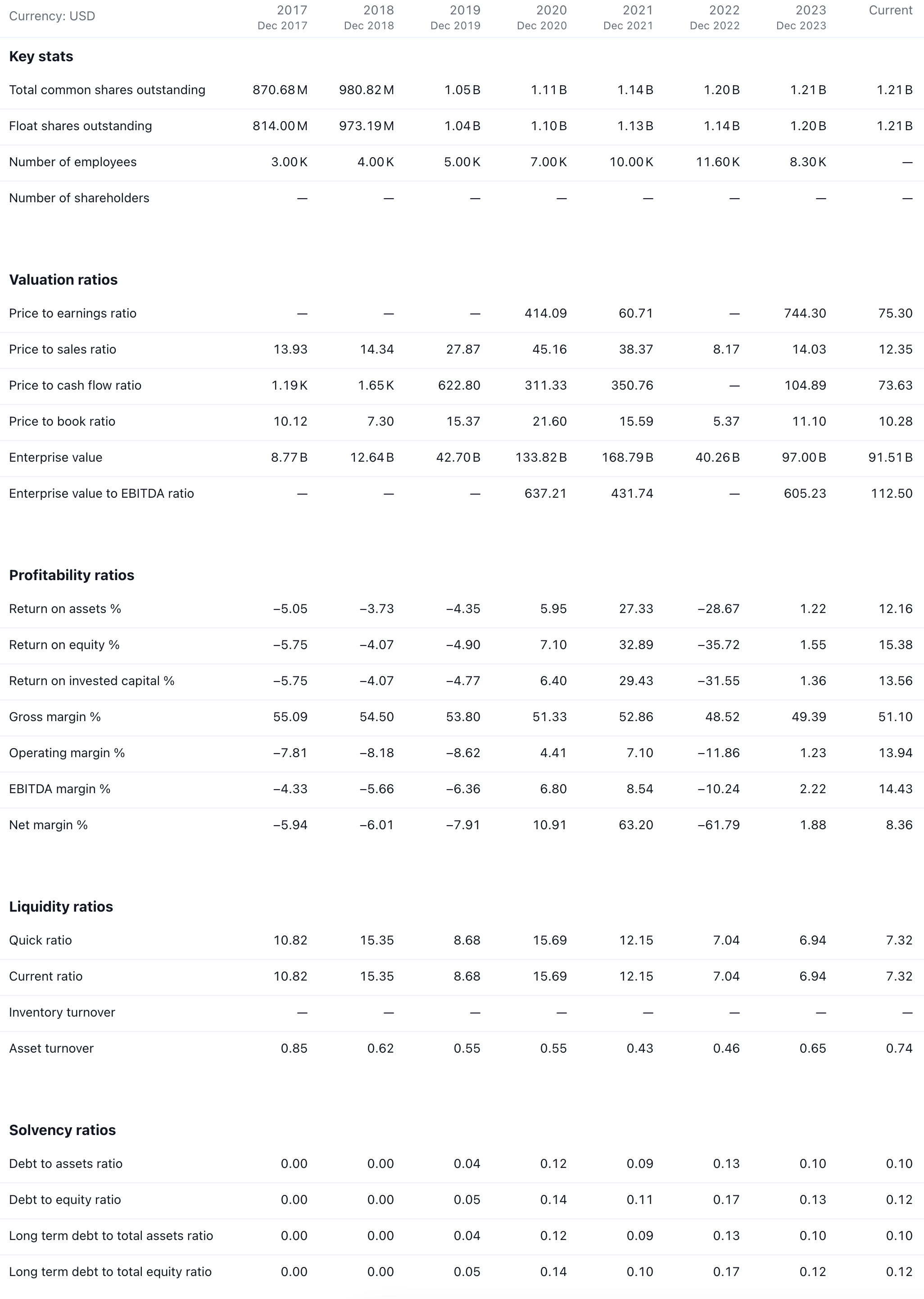

The following data snapshots are as of 08/29/2024 from tradingview website

Key Stats

Performance since IPO

Financial Statements

Income Statement

Balance Sheet

Cash flow

Statistics

Sources: Google Doc

Unlock the power of compounding

We are changing the way that people build wealth. If your portfolio is performing below S&P 500 in the last 5 years, then you need to subscribe here. Discover remarkable stories directly to your inbox. As a subscriber, you'll receive the valuable recommendation of an exceptionally outstanding company that are designed to help you build wealth.

Gain access to exclusive benefits by subscribing today!

Disclaimer: Please note that this newsletter is a financial information publisher and not an

investment advisor. Subscribers should not view this newsletter as offering personalized legal or investment

counseling. Investors should consult with their investment advisor and review the prospectus or financial / stock

recommendation of the issuer in question before making any investment decisions. All articles, blogs, comments,

emails, and chatroom contributions - even those including the word "recommendation" - should never be construed as

official business recommendations or advice. Liability of all investment decisions resides with the individual

investor.

Snowball Investing does not provide any guarantees, warranties, or representations, whether explicitly or

implicitly, regarding the accuracy, reliability, completeness, or reasonableness of the information presented. The

opinions, assumptions, and estimates expressed represent the author's viewpoints as of the publication date and are

subject to modification without prior notification. Projections made within the document are based on various market

condition assumptions, and there is no assurance that the anticipated results will be attained. Snowball Investing

disclaims any responsibility for losses incurred due to reliance on this document's content. It is important to note

that Snowball Investing is not offering financial, legal, accounting, tax, or other professional advice, nor is it

assuming a fiduciary role.

Member discussion