2025 Annual Letter

Dear Snowball Investing community,

As we close out another year in the markets, we want to reflect on how far our portfolio has come, what shaped the investing landscape in 2025, and how we plan to navigate the road ahead together. From the start, Snowball Investing has been about making long-term investing simple and approachable—helping everyday investors build real wealth by focusing on ownership, patience, and the proven power of compounding.

We believe buying pieces of great businesses and holding them for the long run is the most reliable path to financial freedom. No noise. No hype. Just clear explanations, thoughtful research, and a steady process designed to help you make confident decisions—even in uncertain markets.

This year offered a mix of extremes: valuations stretched, interest rates reset expectations, AI-driven optimism accelerated, and global macro forces tested investor discipline. Through all of it, we stayed anchored to our core philosophy: keep things simple, stay focused on quality, and invest with a long horizon.

This letter summarizes our performance, the key lessons of the year, and what we believe matters most as we move into 2026.

Performance of Our Stock Recommendations

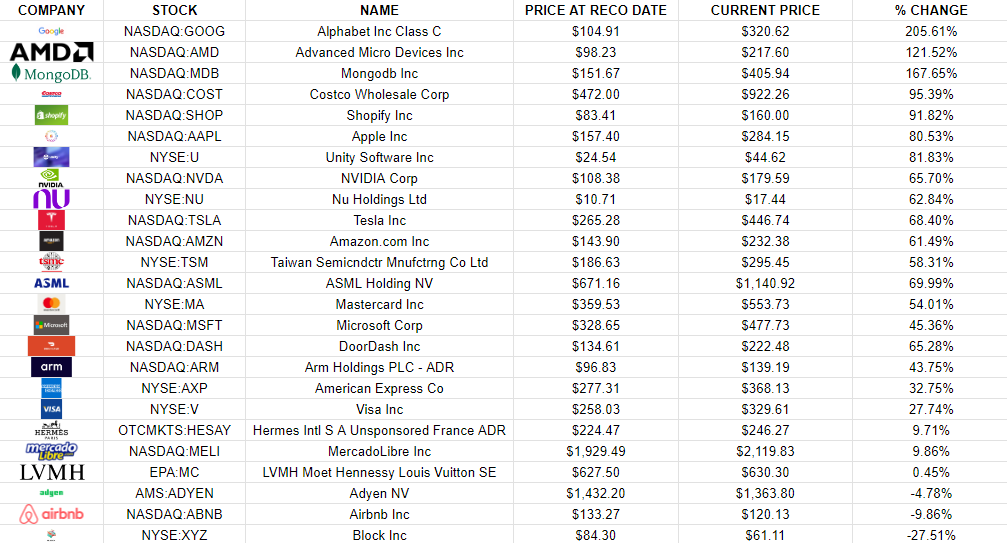

Despite a market that remains broadly overvalued by historical standards, the Snowball portfolio delivered strong absolute and relative performance across many of our recommendations. A number of our highest-conviction ideas meaningfully outperformed major benchmarks. These companies benefited from durable fundamentals, predictable cash flows, and long-term growth levers that continued to compound, driving sustained growth.

Below are the strongest performers since their respective recommendation dates.

Top Performers

Alphabet (GOOG)—+205% Since Recommendation as of 12/3/2025

Alphabet has been one of the strongest contributors to the Snowball portfolio since our initial recommendation in March 2023. We highlighted Alphabet for its durable advertising ecosystem, expanding cloud business, and disciplined investment in AI. Since then, the company has continued to demonstrate resilient cash flow, steady revenue growth, and increasing operational efficiency. Its leadership in search, YouTube, and cloud services—combined with rapid advancements in generative AI and ongoing share repurchases—helped drive meaningful share-price appreciation. Alphabet remains a core example of our long-term approach: owning high-quality businesses with sustainable competitive advantages and letting fundamentals compound.

MongoDB (MDB)—+115% Since Recommendation as of 12/3/2025

MongoDB has delivered exceptional returns since our April 2025 recommendation, driven by its position as a foundational database platform for modern applications. We identified MongoDB for its strong developer adoption, high switching costs, and a subscription-based model that generates predictable recurring revenue. The continued shift toward cloud-native architectures and the growing need for flexible, scalable data solutions have reinforced MongoDB’s role as a mission-critical tool for enterprises. With Atlas adoption accelerating and long-term customer spending expanding, MongoDB’s fundamentals have supported sustained share-price growth—validating our thesis that essential infrastructure software compounds reliably over time.

Advanced Micro Devices (AMD)—+118% Since Recommendation

AMD has been a standout performer since we recommended the company in March 2025. Our thesis centered on AMD’s strengthening position in high-performance computing, data centers, and AI acceleration—all areas experiencing sustained demand growth. The company continued gaining market share with competitive products across CPUs and GPUs, while its AI accelerator roadmap captured enterprise and hyperscaler interest. Strong execution, expanding margins, and consistent product leadership helped reinforce AMD’s role as a key player in the AI and cloud infrastructure ecosystem. Its performance reflects the power of owning technologically relevant businesses with long-term secular tailwinds.

Costco (COST) — +92% Since Recommendation as of 12/3/2025

Costco has delivered strong, steady gains since our March 2023 recommendation, supported by one of the most resilient business models in retail. We identified Costco for its membership-driven revenue base, consistent traffic growth, and industry-leading operational efficiency. Throughout the period, Costco continued to demonstrate disciplined pricing, strong renewal rates, and expanding same-store sales—even in a mixed consumer environment. Its ability to generate dependable cash flow, maintain customer loyalty, and deliver value at scale has allowed the company to compound steadily. Costco’s performance highlights the reliability of owning high-quality, everyday-essential businesses in any market cycle.

Shopify (SHOP)—+91% Since Recommendation as of 12/3/2025

Shopify has nearly doubled since our October 2024 recommendation, driven by its continued evolution into a full-stack commerce operating system for businesses of all sizes. We highlighted Shopify for its expanding suite of merchant tools—from payments to logistics to AI-enhanced commerce features—that deepen customer engagement and increase platform monetization. The company’s ability to scale revenue across software subscriptions, transaction fees, and value-added services has strengthened its competitive position in global e-commerce. Shopify’s performance reflects the power of owning platform businesses with strong network effects and long-term structural tailwinds.

These results reflect a consistent investment process: identifying companies with strong balance sheets, defensible moats, and multi-year growth potential—and then exercising the patience required to let compounding work its magic.

What Sets the Snowball Investing Newsletter Apart

The Snowball Investing Newsletter is built on a simple goal: to help everyday investors grow wealth through long-term, disciplined investing. Instead of chasing short-term market moves or trying to predict the next headline, we focus on teaching the principles that make compounding work—clarity, patience, and quality.

Three things define how we approach research and why readers find value in it:

A focus on business fundamentals, not stock speculation

We look at companies the way long-term owners do: evaluating their business models, competitive advantages, growth runways, and financial strength. Our recommendations stem from understanding how a business creates value over time, not from reacting to market noise. This aligns with our philosophy that stocks are pieces of real companies, not lottery tickets.

Clear and accessible explanations

One of Snowball’s core commitments is to make investing understandable. Every issue breaks down complex ideas—valuation, earnings, interest rates, and industry trends—into plain language. This empowers readers to make confident decisions, even if they’re new to investing or managing modest portfolios.

A long-term approach guided by timeless principles

We emphasize buying great companies at reasonable prices, holding them through cycles, and letting compounding do the heavy lifting. These principles form the foundation of the Snowball approach and mirror what has worked for decades: stay diversified, invest regularly, and avoid emotional decision-making.

Combined, these elements create a process that helps readers stay grounded during volatility and focused during periods of market optimism. Our role is not to predict the future but to help investors build habits and portfolios that work across many futures.

Current Market Conditions: Key Trends Shaping 2025

The World at a Glance

Global equity markets recently posted gains—a rebound supported by rising optimism around potential U.S. rate cuts and easing pressure on global yield curves. But despite this improvement in market sentiment, the broader macro backdrop remains mixed.

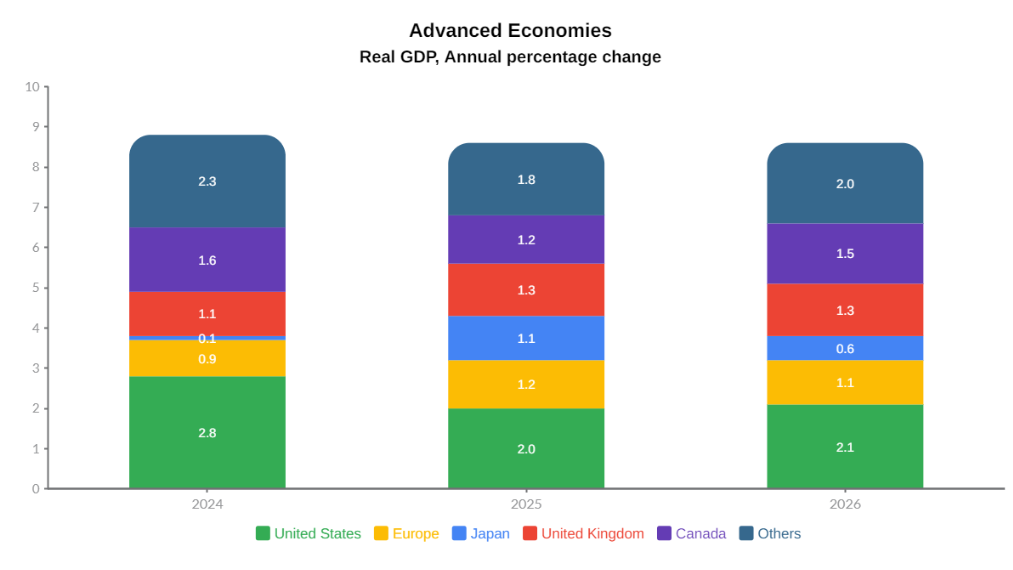

According to the IMF’s World Economic Outlook, global growth is moderating as economies absorb the lagged effects of tighter monetary policy, slower trade activity, and ongoing geopolitical tensions. The recovery is uneven: advanced economies—including the United States, Canada, Japan, and most of Western Europe—are projected to grow more slowly, while emerging markets such as China, India, and much of Southeast Asia continue to carry a larger share of global expansion.

The table below summarizes the IMF’s real GDP growth projections (annual percent change) for major economic groups from 2024 to 2026, illustrating both the slowdown in advanced economies and the relatively stronger momentum in emerging and developing regions.

| World Output | 2024 | 2025 | 2026 |

|---|---|---|---|

| Advanced Economies | 1.8 | 1.6 | 1.6 |

| Emerging Markets and Developing Economies | 4.3 | 4.2 | 4.0 |

The World Bank’s Global Economic Prospects similarly notes that global growth is slowing and becoming more fragile, reflecting weaker investment, rising fiscal pressures, and structural challenges such as supply-chain realignment and declining productivity in mature economies. While some regions show resilience, the overall environment remains more sensitive to shocks than in previous cycles.

Together, these trends explain why global markets are responding sharply to macro data, policy signals, and cross-border capital flows. Investors continue to balance cautious optimism with the reality that global growth is slowing, risks are unevenly distributed, and valuations in many regions remain influenced more by expectations than economic fundamentals.

Stateside Market Check

The U.S. market continues to be shaped by a shifting macro backdrop: evolving expectations for Federal Reserve policy, solid corporate earnings, uneven sector performance, and persistent excitement—mixed with skepticism—around AI. While headline indexes appear strong, the underlying picture is more nuanced. Understanding the drivers beneath the surface is essential for long-term investors navigating a market where momentum and fundamentals are not always aligned.

Equities lifted by rate-cut hopes and stronger earnings

U.S. equities recently rose as traders grew increasingly confident that the Federal Reserve could begin reducing interest rates in the months ahead. This shift in expectations helped ease concerns around elevated valuations, particularly across the technology and AI ecosystem, where stocks are more sensitive to discount-rate movements.

Market strength was further supported by a broadly positive earnings season. So far, a large majority of reporting companies in the S&P 500 have beaten expectations, with roughly 83% of those that have reported delivering positive earnings surprises. For now, the combination of easing rate pressure and resilient corporate profitability is offering support to equity markets.

Volatility lingers, especially in speculative and AI-exposed names

Despite the rally, day-to-day volatility has remained elevated, especially among high-growth, AI-sensitive companies. In several recent sessions, markets opened strongly on upbeat earnings from major tech firms, only to reverse sharply as investors reassessed how realistic current AI-driven growth expectations may be.

These swings reflect a broader reevaluation of risk: investors are becoming more cautious about paying premium multiples for companies whose long-term earnings pathways remain uncertain. As enthusiasm cools in certain corners of the AI trade, price action has become more erratic—highlighting the gap between excitement and proven monetization.

Dollar softens as Treasury yields ease

The U.S. dollar has weakened on rising expectations of rate cuts. A softer dollar influences global markets through multiple channels:

- It eases financial conditions in emerging markets.

- It improves currency translations for U.S. multinationals.

- It affects capital flows and commodity pricing.

At the same time, declining Treasury yields have reduced discount-rate pressure on long-duration growth stocks—one of the factors contributing to recent strength in tech. Lower yields also signal improving investor confidence that inflation is moderating, though the path ahead remains data-dependent.

Narrow leadership beneath headline strength

While major indexes like the S&P 500 and Nasdaq have rallied, the participation beneath the surface remains narrow. A small group of mega-cap technology and AI-adjacent companies continues to drive an outsized share of returns. Many other segments—small caps, industrials, financials, and rate-sensitive cyclical sectors—have lagged meaningfully.

This concentration increases overall market vulnerability: if sentiment or earnings expectations shift for just a few large companies, it could disproportionately impact the broader index. For long-term investors, the current environment reinforces the importance of understanding where growth is genuinely broad-based versus where it is concentrated in a handful of firms.

Bond Market Update: Yields, Trends, and What Investors Should Know

The bond market has undergone a meaningful transition this year — one that quietly influences everything from equity valuations to investor behavior. After years of distortions driven by ultra-loose monetary policy and pandemic-era shocks, fixed income is finally returning to a more historically recognizable role in investor portfolios.

Key Trends in the Bond Market

Short-term yields have eased as inflation cools and expectations shift.

With inflation steadily moderating and growth stabilizing, markets are increasingly pricing in a transition away from restrictive policy. Commentary from firms such as Sequoia Financial and Wells Fargo notes that short-duration Treasury yields have drifted lower as investors look ahead to potential policy normalization in 2026.

Long-term yields remain elevated despite easing at the front end.

While short-term yields have shown some softening, longer-dated Treasuries — including the 10-year and 30-year — remain anchored at historically elevated levels. The 10-year Treasury yield has recently hovered around 4.1%, according to verified data from the Federal Reserve Bank of St. Louis (FRED). This persistence reflects deeper structural forces: large fiscal deficits, increased Treasury issuance, and a higher term premium demanded by investors for holding duration risk.

The yield curve is gradually normalizing.

After one of the longest inversions in decades, the yield curve has begun a slow re-steepening. A normalized curve often corresponds with improving macro expectations and re-establishes the traditional relationship between stocks and bonds — where fixed income can once again provide meaningful downside protection.

Fixed income is offering real income again.

For the first time in more than a decade, investment-grade bonds deliver competitive real yields. This restores fixed income as a genuine contributor to portfolio returns rather than a placeholder — especially across short and intermediate maturities, where volatility remains more contained.

Long-duration volatility remains elevated.

The long end of the curve continues to react sharply to fiscal headlines, inflation prints, and policy guidance. Some analysts describe this environment as one where “bond vigilante” behavior has re-emerged — investors demanding higher compensation for lending to a heavily indebted government. This volatility presents both risk and opportunity depending on an investor’s horizon.

A Verified Look at the Bond Market

The chart below reflects the 10-Year Treasury Constant Maturity Rate (DGS10), sourced from the Federal Reserve Bank of St. Louis (FRED). It highlights the persistence of elevated long-term yields and the rate dynamics shaping today’s fixed-income environment.

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, December 2, 2025.

What This Means for Long-Term Investors

For long-term investors following Snowball’s philosophy, today’s bond market dynamics are mostly constructive:

- Income is back: Bonds once again offer meaningful yield, reducing reliance on equities for total return.

- Diversification strength is returning: A healthier yield curve improves fixed income’s role as a stabilizer during equity volatility.

- Volatility creates opportunity: Elevated long-end swings can create attractive entry points for disciplined investors.

- Balanced portfolios are more resilient: Attractive yields across various maturities help smooth returns across uncertain market conditions.

As the fixed-income landscape stabilizes, bonds are reclaiming their historic role: a meaningful, dependable component of long-term wealth-building.

How Fed Interest Rate Changes Shape Long-Term Investing

The Federal Reserve spent the past several years navigating the complex balance between inflation, economic stability, and financial conditions. As inflation has eased and growth has stabilized, the Fed has shifted from aggressive rate hikes to a more neutral stance, with markets increasingly expecting cuts to begin in 2026.

Understanding how these rate changes interact with long-term investing is crucial because they influence markets differently depending on the time horizon.

Short-term effects are immediate and mostly psychological

Investopedia notes that interest-rate hikes or cuts often trigger sharp short-term market reactions—not because business fundamentals change overnight, but because investor expectations do. Higher rates increase borrowing costs and raise discount rates, which can pressure valuations, while lower rates make future earnings more valuable and tend to support equity prices.

U.S. Bank’s research reinforces this dynamic, explaining that rate changes influence market sentiment by altering financing costs, consumer demand, and corporate profitability. Rising rates can create headwinds for more rate-sensitive areas of the market, while steady or falling yields typically ease financial conditions and help support stock performance—particularly when paired with solid earnings.

These reactions are real but temporary. They are often driven by sentiment and discount-rate adjustments rather than changes in long-term business value. Investors can be misled if they confuse short-term volatility with meaningful shifts in a company’s long-term fundamentals.

Long-term outcomes are driven by business fundamentals, not Fed cycles

While the Federal Reserve shapes financial conditions in the short run, it does not determine the long-term value or earnings power of a business. Over multi-year horizons, investment returns are overwhelmingly driven by fundamentals — not by the timing of rate hikes or cuts.

The factors that matter most include:

- Revenue growth: A company’s ability to expand its top line sustainably.

- Margins and pricing power: The ability to protect or expand profitability through cycles.

- Reinvestment opportunities: How effectively a business deploys capital to fuel future growth.

- Competitive advantages: Structural moats that allow companies to maintain or grow market share.

- Disciplined capital allocation: Management’s ability to make rational, long-term decisions with shareholders in mind.

These fundamentals compound over time, while Fed cycles come and go. For long-term investors, staying anchored to business quality rather than policy shifts is both more reliable and more rewarding.

The cost of capital sets the bar for returns

Higher interest rates increase borrowing costs and raise the expected return investors demand from riskier assets. This means:

- Companies with weak balance sheets or debt-heavy models struggle

- Speculative and profitless firms lose support

- Capital flows toward stable, cash-generating businesses

Lower rates do the opposite: they reduce financing costs, encourage investment and innovation, and generally support higher equity valuations.

But over time, neither environment inherently destroys returns—they simply shape which kinds of companies thrive.

Rate changes reinforce the value of long-term discipline

Historical evidence shows that investors who try to time Fed policy—exiting when rates rise or piling in when rates fall—underperform those who stay consistently invested. This is because the market often moves before the policy actually changes.

In fact, many of the strongest multi-year bull markets began during periods of elevated rates or tightening cycles, because fundamentals ultimately mattered more than policy shifts.

Bonds regain importance in a normalized rate environment

With higher yields, fixed-income assets provide real, meaningful returns again. Rising rates reintroduce:

- income generation

- diversification benefits

- improved risk-control

- opportunities across duration and credit quality

This environment supports more balanced portfolios—a contrast to the zero-rate era, where equities were often the only path to returns.

The bottom line

Federal Reserve decisions shape short-term market psychology and valuation cycles, but they do not alter the long-term compounding ability of strong businesses.

For Snowball investors, the most reliable strategy remains unchanged: Stay focused on fundamentals, maintain valuation discipline, and allow time to smooth out the noise of rate cycles.

Navigating Today’s Overvalued Market Environment

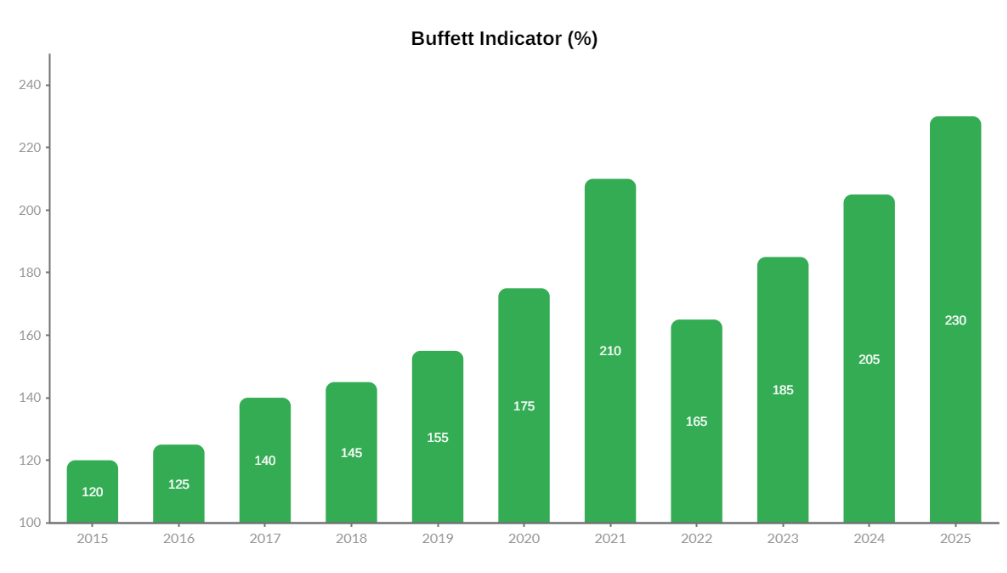

Multiple valuation models continue to indicate that U.S. equities are trading above their long-term historical ranges. GuruFocus’ market valuation overview shows that several key indicators — including price-to-earnings, price-to-sales, and market cap-to-GDP — remain elevated relative to their long-run averages. The Buffett Indicator, as tracked by Current Market Valuation, tells a similar story: the total U.S. stock market sits well above its historical trendline, even after accounting for improved corporate earnings in recent years.

The chart above visualizes a simplified 10-year view of the Buffett Indicator, which measures total U.S. market value relative to GDP. The indicator shows a steady rise over the past decade, reaching roughly 230% in 2025 — about 77% above the long-term historical trend. This reinforces a consistent message across valuation frameworks: U.S. equities are currently priced at levels that leave less room for macro, policy, or earnings disappointments.

While exact valuation levels vary across models, the broader conclusion is clear. Prices have outrun fundamentals in several areas of the market, compressing the margin for error and increasing sensitivity to shifts in economic data or investor sentiment.

Despite this, market psychology has not turned bearish. Participation remains strong, particularly in sectors tied to long-term themes such as technology and AI. Yet beneath the surface, investors recognize that valuations are elevated and that future returns may rely more heavily on sustained earnings growth and stable macro conditions. This blend of continued optimism and underlying caution is characteristic of late-cycle environments — when markets can advance, but with increasing fragility.

What Characterizes Today’s Overvalued Environment?

Valuations have expanded faster than fundamentals.

Corporate earnings have improved, yet market prices — particularly in large-cap technology and AI-linked sectors — have grown even faster. This has pushed valuation multiples above long-term averages and increased sensitivity to negative surprises.

Market leadership is narrow.

A small group of mega-cap companies continues to drive a disproportionate share of overall index gains. Broader market participation remains uneven, with many sectors trailing behind headline performance. Narrow leadership is often associated with later stages of a market cycle.

Expectations are doing more work than fundamentals.

Much of the recent market strength reflects anticipated improvements — such as potential rate cuts, AI-driven productivity gains, and longer-term innovation tailwinds. These expectations may take time to materialize, and in some areas may prove overly optimistic.

Investor psychology is mixed.

Market participants are optimistic enough to remain invested, but increasingly aware that valuations leave little room for error. This tension contributes to sharper reactions to economic data, earnings releases, or policy shifts.

How Snowball Investing Navigates an Overvalued Market

Periods of elevated valuations call for discipline and clarity — not retreat. Our approach remains intentionally steady:

1. Maintain a higher bar for new positions.

We prioritize businesses with durable advantages, strong free cash flow, robust balance sheets, and clear reinvestment opportunities — companies that can justify premiums through compounding earnings.

2. Lean on valuation discipline and position sizing.

We avoid areas where expectations appear excessive and allocate more gradually in spaces where fundamentals remain aligned with price.

3. Use dollar-cost averaging to reduce timing risk.

Rather than attempting to predict short-term peaks or corrections, we rely on consistent investing to smooth entry points in a high-valuation environment.

4. Treat cash and short-duration bonds as strategic tools.

Liquidity offers flexibility. In an overvalued market, holding some cash or safe yield provides stability and allows us to take advantage of volatility when opportunities arise.

5. Avoid chasing speculative themes.

High-valuation environments often elevate unproven business models. We remain anchored in companies with predictable earnings, real customers, and demonstrated long-term viability.

6. Focus on fundamentals, not forecasts.

Economic sentiment may shift quickly, but quality companies with strong cash flows and competitive advantages tend to compound value regardless of short-term volatility.

An overvalued market is not a reason to withdraw — it is a reason to be thoughtful. With valuations elevated, market leadership concentrated, and expectations running high, investors benefit most from quality, patience, and disciplined entry points. Our role at Snowball Investing is to help long-term investors navigate exactly this kind of environment with clarity and confidence.

The AI market boom and current risks

Artificial intelligence remained the most powerful market force of 2025. Capital formation accelerated, corporate adoption expanded, and investor expectations continued to rise. Yet alongside the rapid innovation, several new risks have emerged — risks tied not just to technology, but to valuations, concentration, and the structure of the market itself.

Recent reporting from Reuters highlights a clear pattern: AI is reshaping industries at a remarkable pace, but the surge in investment and market enthusiasm has also made the sector more vulnerable to excess. As money continues to flow into AI infrastructure, applications, and M&A activity, concerns are growing that expectations may be outpacing the near-term economic realities.

Where the AI boom is creating real value

AI infrastructure remains the most durable part of the ecosystem. Semiconductor manufacturers, cloud platforms, networking providers, and companies enabling model training and inference continue to show strong revenue growth and high capital investment. Demand for compute, memory, and data-center buildout remains robust, and many of these businesses have clear visibility into multi-year orders.

Enterprise adoption is meaningful. Large corporations have accelerated spending on efficiency tools, automation, and analytics. This creates recurring revenue streams for the largest AI service providers and helps justify the infrastructure expansion happening behind the scenes.

Productivity gains are real in certain sectors. Companies in healthcare, retail, logistics, and finance have reported early cost savings or workflow improvements tied to AI deployment — though these gains are uneven and still in early stages.

Where the risks are building

Valuations have expanded far faster than earnings.

Recent reporting from CNBC highlights growing concern that many AI-linked companies — particularly in the application and software layers — are trading at valuations difficult to justify based on their current revenue or cash-flow profiles. Much of the recent appreciation appears to be driven by long-term expectations rather than fundamentals, increasing the risk of sharp repricing if growth assumptions cool.

Capital is chasing the same winners.

Investment flows and corporate spending remain heavily concentrated in a small group of dominant AI players. Such narrow leadership raises systemic risk: if even one major company underperforms, the impact could ripple through the broader market.

Expansion activity reflects rising expectations.

Rapid hiring, rising compute investment, and aggressive capacity buildout across the sector point to rising competitive pressure and a race to secure strategic positioning. While some of this is justified by real demand, periods marked by accelerated spending and elevated valuations often signal stretched assumptions and thinner margins for error.

Commercial viability remains uneven. Many AI applications still struggle with:

- unclear pricing power

- weak differentiation

- high compute costs

- dependence on third-party models

- inconsistent user retention

This creates a wide gap between narrative value and economic value.

Regulatory pressure is increasing. Governments globally are more active in shaping AI safety, data privacy, copyright, and model accountability. Regulatory frameworks are tightening, and compliance costs may rise for both model developers and application builders.

Hardware and energy constraints are emerging. Rapid scaling of compute has exposed bottlenecks in chip supply, advanced packaging, and power consumption. These constraints could slow deployment or alter the economics of model training.

Snowball Investing’s approach to the AI cycle

Our philosophy emphasizes participation without speculation. We focus on:

- Infrastructure leaders with clear demand, recurring revenue, and durable moats

- Profitable companies that benefit from AI adoption rather than rely on it

- Cash-generating businesses with diversified revenue streams

- Avoiding unproven application-layer companies whose valuations assume outcomes not yet supported by data

AI will continue to reshape industries over the next decade, but that does not mean every AI-related investment will reward shareholders. Our goal is to invest where the economics are strongest, the competitive advantages are clearest, and the long-term runway is real — not merely promised.

Principles for Investing in Today’s Market

Periods of elevated valuations, shifting interest-rate expectations, and rapid technological change can tempt investors into short-term behavior. History shows that the best outcomes come from doing the opposite — staying grounded in simple, durable principles that work across all market cycles.

A few lessons matter more now than ever:

Quality compounds; speculation distracts. When markets become expensive, lower-quality companies often look “cheap” relative to the index. But valuation alone cannot fix a weak business model. In uncertain environments, high-return, cash-generating companies remain the strongest foundation for compounding.

Patience is a competitive advantage. Most investors overreact to short-term volatility or chase the latest narrative. Investors who wait for fair prices, who hold through noise, and who allow earnings to compound quietly in the background tend to outperform over long horizons.

Valuation discipline is not optional. In cheaper markets, mistakes are forgiving. In expensive markets, they are costly. Buying great companies at reasonable prices — not at any price — becomes increasingly important as aggregate valuations stretch.

Cash is optionality, not a burden. Holding cash or short-duration bonds is beneficial in periods of uncertainty. Optionality allows investors to act decisively during pullbacks, when the best opportunities typically appear. Liquidity is a tool, not a drag.

Avoid false diversification. Owning many stocks is not the same as being diversified. True diversification comes from owning businesses with different economic drivers, not simply owning more tickers. This is especially important when market leadership is narrow.

Separate company performance from stock performance. Prices often move faster than fundamentals in both directions. The goal is to own businesses that continue to grow earnings and expand their competitive advantages, regardless of how the market prices them in the short run.

Stick to process, not prediction. Macroeconomic forecasts, rate predictions, and market timing contribute more noise than value. A disciplined, repeatable process — focused on fundamentals, valuation, and patience — is far more reliable.

These principles are simple, but not easy. They require restraint in euphoric markets and courage in difficult ones. For Snowball Investing, following these core ideas has been essential to protecting capital, capturing long-term returns, and helping our community build wealth one step at a time.

Looking Ahead, Together

As we wrap up this year’s letter, we want to thank you for being part of the Snowball Investing community. Markets will always move between optimism and uncertainty, between periods of stretch and periods of opportunity. What has not changed — and what we believe will continue to serve long-term investors best — is the discipline of owning great businesses, staying patient, and letting compounding do the heavy lifting.

This year reminded us that headlines come and go, cycles turn, and narratives shift quickly. But thoughtful investing is still built on fundamentals, simplicity, and time. Whether the market is euphoric or cautious, overvalued or fearful, our goal remains the same: to give you clear research, grounded perspectives, and a calm voice to help you navigate whatever comes next.

As we look ahead to 2026, we expect an environment shaped by moderating inflation, gradually easing policy, and continued innovation across both traditional industries and AI-driven platforms. Valuations may shift, leadership may broaden, and opportunities may emerge in areas where fundamentals and price finally reconnect. Through these changes, we’ll continue refining our research, sharing clear explanations, and highlighting companies that demonstrate durable economics and real long-term potential. Our focus remains the same: helping you invest with clarity, confidence, and patience, no matter what the next cycle brings.

Thank you for your trust and your commitment to growing alongside us. We look forward to continuing this journey with you — building wealth one snowball at a time.

— The Snowball Investing Team

Sources: Google Doc

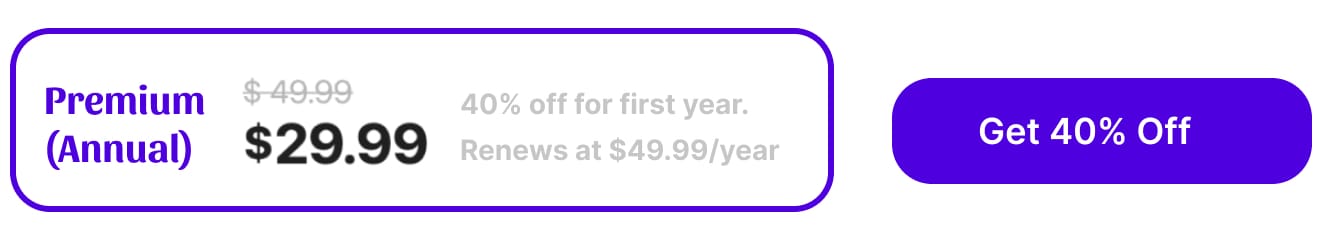

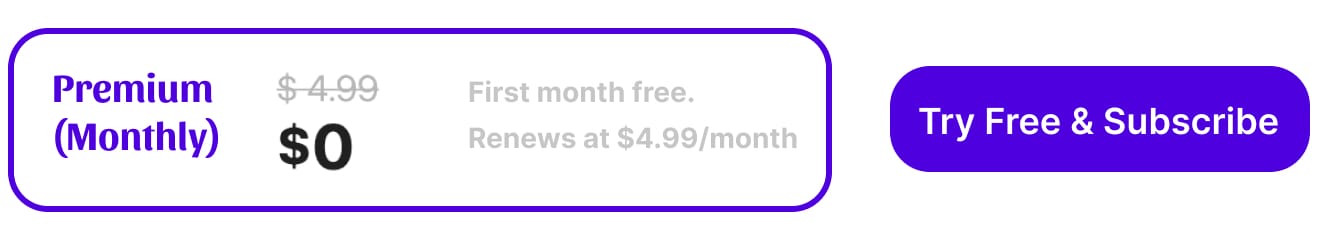

Unlock the power of compounding

We are changing the way that people build wealth. If your portfolio is performing below S&P 500 in the last 5 years, then you need to subscribe here. Discover remarkable stories directly to your inbox. As a subscriber, you'll receive the valuable recommendation of an exceptionally outstanding company that are designed to help you build wealth.

Gain access to exclusive benefits by subscribing today!

Disclaimer: Please note that this newsletter is a financial information publisher and not an

investment advisor. Subscribers should not view this newsletter as offering personalized legal or investment

counseling. Investors should consult with their investment advisor and review the prospectus or financial / stock

recommendation of the issuer in question before making any investment decisions. All articles, blogs, comments,

emails, and chatroom contributions - even those including the word "recommendation" - should never be construed as

official business recommendations or advice. Liability of all investment decisions resides with the individual

investor.

Snowball Investing does not provide any guarantees, warranties, or representations, whether explicitly or

implicitly, regarding the accuracy, reliability, completeness, or reasonableness of the information presented. The

opinions, assumptions, and estimates expressed represent the author's viewpoints as of the publication date and are

subject to modification without prior notification. Projections made within the document are based on various market

condition assumptions, and there is no assurance that the anticipated results will be attained. Snowball Investing

disclaims any responsibility for losses incurred due to reliance on this document's content. It is important to note

that Snowball Investing is not offering financial, legal, accounting, tax, or other professional advice, nor is it

assuming a fiduciary role.

Member discussion