Investment Thesis: Nike

Nike, Inc. (NYSE: NKE) is more than the world’s largest athletic footwear and apparel company; it is a cultural force operating at the intersection of sport, style, and self-expression. From iconic sneakers that define generations to performance gear trusted by elite athletes, Nike has embedded itself into how people move, dress, and identify worldwide. Its ability to remain relevant across both competitive sports and everyday lifestyle wear gives it a rare and durable edge in a crowded global market. For long-term investors, Nike offers exposure to powerful secular trends, including rising global sports participation, the normalization of athleisure as everyday wear, and the continued expansion of direct-to-consumer channels that strengthen brand control, customer engagement, and margin potential. Together, these factors position Nike as a brand built not just to sell products but to compound value over time.

This recommendation is just a start. The next step is to do your due diligence process, which will then help you make the investment decision. We strongly advise investors to do a thorough analysis of the recommendation and understand the soundness of the business before investing in this company. Also, please consult your investment advisor before making a decision.

Business Profile (NYSE: NKE)

What the Company Does

Nike, Inc. designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories across performance and lifestyle categories. The company combines innovation, design, and storytelling to serve both elite athletes and everyday consumers. Its brand portfolio includes Nike, which anchors performance and lifestyle sportswear; Jordan Brand, a category-defining franchise blending basketball heritage with street culture; and Converse, a classic footwear brand with strong appeal among youth and creative communities. Together, these brands allow Nike to address a broad spectrum of consumers, from high-performance athletes to sport-inspired casual wear customers.

When & Where It Was Founded

Nike was founded in 1964 in Eugene, Oregon, by Phil Knight and Bill Bowerman under the name Blue Ribbon Sports. Initially a distributor of Japanese running shoes, the business was deeply rooted in the running community, with Bowerman experimenting relentlessly to improve athletic performance through footwear design. In 1971, the company rebranded as Nike, marking its transition from distributor to innovator and manufacturer. Early success in running footwear laid the groundwork for Nike’s rapid expansion across sports categories.

Ticker Symbol, Listings & Global Reach

Nike is publicly listed on the New York Stock Exchange under the ticker NKE and operates one of the most extensive global distribution networks in consumer goods. The company serves markets across North America, Europe, the Middle East and Africa (EMEA), Greater China, and Asia Pacific & Latin America (APLA). Its products are sold in more than 170 countries through a mix of owned retail stores, wholesale partners, and digital platforms such as the Nike App and SNKRS. This scale, combined with a growing direct-to-consumer ecosystem, enables Nike to maintain broad market penetration while adapting to regional consumer preferences.

Story

Founders & Vision

Nike was built on the belief that performance starts with design, and that the best products are born from direct engagement with sport. The company’s origins trace back to a simple handshake between Phil Knight, a young runner and Stanford MBA student, and Bill Bowerman, his track coach at the University of Oregon. That handshake marked the informal beginning of what would later become Nike, grounded in mutual trust, shared curiosity, and a belief that athletes deserved better equipment than what was available at the time.

Bowerman approached footwear as a performance variable rather than a commodity. He believed that small design improvements could translate into meaningful competitive advantages, leading him to constantly experiment with materials, traction, and weight. His hands-on approach to innovation, which included prototyping shoes himself and soliciting direct athlete feedback, established a culture of relentless testing and iteration. One of his most famous breakthroughs, the Waffle sole, emerged from an improvised experiment using a waffle iron, reflecting his belief that innovation could come from unconventional thinking and practical experimentation.

Knight complemented Bowerman’s inventive mindset with a focus on building a scalable business. While Bowerman concentrated on product performance, Knight focused on distribution, partnerships, and long-term brand development. The founders’ relationship was never formalized through rigid contracts in the early years; instead, it was built on trust, shared risk, and a willingness to figure things out as they went. This early informality fostered a culture of entrepreneurship, speed, and adaptability that would later become a defining characteristic of Nike.

Together, Bowerman and Knight embedded athlete insight, innovation, and authenticity into Nike’s DNA, shaping a company that prioritized performance credibility while remaining open to experimentation and change.

Timeline of Key Growth Milestones

Nike’s early growth was driven by a lean, grassroots distribution model, selling running shoes directly to athletes at track meets and competitions. This proximity to athletes allowed the company to refine products quickly and build credibility within the running community. Breakthrough innovations such as the Waffle sole and later Air cushioning technology established Nike as a leader in performance footwear and differentiated the brand from competitors focused primarily on manufacturing scale.

As demand grew, Nike expanded internationally across Europe and Asia while strengthening its position in North America. Athlete endorsements became a defining pillar of Nike’s strategy, transforming sports marketing into a storytelling engine that connected elite performance, aspiration, and everyday consumers. Rather than simply promoting products, Nike built narratives around athletes, moments, and cultural impact, elevating brand identity alongside product innovation.

In more recent years, Nike has entered a new phase of evolution by shifting toward direct-to-consumer and digital platforms. Investments in owned retail, e-commerce, and mobile apps have given Nike greater control over brand presentation, pricing, and consumer data, while deepening customer relationships and improving long-term margin potential.

Product Evolution & Brand Expansion

What began as a running shoe company has evolved into a multi-sport and lifestyle powerhouse. Nike steadily expanded into basketball, training, football, and global sports, building leadership positions across major athletic categories. Jordan Brand grew from a single athlete partnership into a standalone franchise that blends performance, fashion, and cultural influence, becoming one of the most valuable brands in global sportswear. Converse further broadened Nike’s reach into classic, youth-driven, and creative segments, complementing Nike’s performance-led portfolio.

Over time, Nike expanded its focus into women’s sports, lifestyle apparel, and athleisure, reflecting shifts in consumer behavior and the blurring line between sport and everyday wear. Today, Nike’s portfolio bridges elite performance and daily lifestyle use, reinforcing the founders’ original belief that great design rooted in sport can scale globally and endure across generations.

Business Model: How Nike Makes Money

Nike operates a brand-led, asset-light business model centered on the design, innovation, marketing, and global distribution of athletic footwear, apparel, equipment, and accessories. As the world’s largest seller of athletic footwear and apparel, the majority of its revenue is generated from these categories. While products are engineered for performance, a significant portion is worn casually, allowing Nike to capture both sport-driven demand and everyday lifestyle consumption.

Nike’s product offering spans footwear, apparel, and select equipment and accessories, serving men, women, young athletes, and children, with men accounting for the largest share of revenue. Its portfolio is organized across performance and lifestyle categories, with Running, Jordan Brand, and Sportswear representing the most meaningful revenue contributors. This mix enables Nike to balance more cyclical, sport-specific demand with steadier lifestyle-driven sales.

A defining characteristic of Nike’s model is its fully outsourced manufacturing structure. The company does not produce its own goods, relying instead on a global network of independent suppliers across more than 35 countries. This asset-light approach allows Nike to scale efficiently, manage costs, and remain flexible as demand shifts, while concentrating internal resources on research, design, marketing, and brand building. Product quality and innovation are maintained through sustained investment in R&D and tight supply chain controls.

Nike distributes its products through a hybrid channel strategy combining wholesale partners with a growing direct-to-consumer ecosystem. Wholesale provides global reach and volume, while Nike Direct, which includes Nike-owned retail stores and digital platforms, plays an increasingly strategic role. Direct-to-consumer channels support higher margins, greater brand control, richer consumer data, and stronger long-term customer relationships, contributing to more resilient profitability over time.

Beyond physical products, Nike continues to expand into services and experiences, including fitness and training apps, sport-focused content, events, and digitally enhanced retail. This extends the business from transactional product sales toward a broader consumer ecosystem that increases engagement and brand stickiness.

The model is not without challenges. Nike operates in a highly competitive global market that demands continuous investment in innovation and marketing, while shifting consumer preferences introduce execution and inventory risks. Its global footprint also exposes the company to macroeconomic cycles, regulatory changes, trade policy, environmental standards, and data privacy considerations. Despite these risks, Nike’s combination of brand strength, diversified categories, outsourced manufacturing, and expanding direct-to-consumer platform underpins durable cash flow generation and long-term compounding potential.

Brand Portfolio Overview

Nike’s business model is reinforced by a focused, high-impact brand portfolio designed to maximize global relevance, innovation efficiency, and pricing power. Rather than operating a wide array of sub-scale labels, the company concentrates resources behind a small number of globally recognized brands, each serving a distinct consumer and cultural role. Across all brands, Nike’s strategy centers on leading with sport, creating must-have products, building deep personal connections with consumers, and delivering integrated experiences through digital platforms and retail.

Nike Brand

The Nike Brand is the company’s primary revenue and profit engine, spanning footwear, apparel, equipment, and accessories across nearly every major sport and lifestyle category. Nike’s athletic footwear is designed primarily for specific athletic use, with significant emphasis on performance innovation, material science, and high-quality construction. While rooted in sport, a large portion of Nike footwear is also worn for casual and leisure purposes, reflecting the brand’s ability to bridge performance credibility and everyday wear.

Nike apparel mirrors this dual-purpose positioning. Sports apparel is designed for athletic use but increasingly functions as lifestyle wear, supported by consistent branding, shared distribution channels, and coordinated product launches. Nike often markets footwear, apparel, and accessories as integrated collections built around specific sports, training needs, or cultural moments. In addition, licensed college and professional team apparel extends Nike’s reach into fan-based and institutionally anchored demand.

Beyond footwear and apparel, Nike offers a broad range of performance equipment and accessories, including bags, socks, sport balls, eyewear, protective gear, and other sport-specific products. While equipment represents a smaller share of revenue, it reinforces Nike’s position as a comprehensive sport performance brand. Select manufacturing capabilities are also housed within a wholly owned subsidiary focused on material and manufacturing innovation, supporting long-term product development.

Nike Brand products anchor the company’s digital ecosystem and direct-to-consumer strategy. Through owned retail, e-commerce, and mobile platforms, Nike integrates product innovation with personalized consumer experiences, strengthening brand loyalty and improving long-term margin potential.

Jordan Brand

Jordan Brand has evolved from a single athlete partnership into one of the most powerful franchises in global sportswear. Built around the Jumpman trademark, Jordan Brand designs, distributes, and licenses athletic and casual footwear, apparel, and accessories that blend basketball performance with streetwear culture. The brand occupies a unique position at the intersection of sport, fashion, and cultural identity.

Jordan Brand operates as a high-margin growth engine with strong pricing power, driven by limited releases, premium positioning, and sustained cultural relevance. While Jordan Brand results are reported within Nike Brand geographic segments, it functions strategically as a semi-independent franchise with its own design language, storytelling, and consumer base. Its success reinforces Nike’s broader ability to turn athlete partnerships into enduring, scalable brands.

Converse

Converse, a wholly owned subsidiary headquartered in Boston, is reported as a separate operating segment. Converse designs, distributes, and licenses casual sneakers, apparel, and accessories under iconic trademarks such as Chuck Taylor All Star, One Star, Star Chevron, and Jack Purcell. Unlike Nike and Jordan, Converse is less performance-driven and more closely tied to lifestyle, youth culture, and fashion cycles.

Converse provides diversification into casual and style-led demand without directly overlapping with Nike’s performance positioning. Its timeless silhouettes offer longevity across consumer cycles, while collaborations and seasonal updates allow the brand to remain relevant to younger audiences. Converse also operates its own direct-to-consumer and digital channels, contributing incremental scale and margin opportunities within the broader Nike portfolio.

Licensing, Digital Services, and Consumer Experiences

In addition to products sold through wholesale and Nike Direct channels, Nike licenses certain trademarks to unaffiliated partners for apparel, digital devices, applications, and sport-related equipment. These arrangements extend brand reach while limiting capital intensity.

Nike also offers interactive consumer services and experiences, including sport-focused events, fitness and activity apps, training content, and digital features embedded within retail environments. While these services generate limited direct revenue, they strengthen ecosystem engagement, enhance data collection, and deepen long-term consumer relationships across the Nike, Jordan, and Converse brands.

Key Differentiators

Brand Power & Cultural Relevance

Nike is not just an athletic brand but a global lifestyle and cultural icon. Its influence extends beyond sport into fashion, music, and social movements, allowing the brand to remain relevant across generations and geographies. Through emotionally resonant branding and storytelling, Nike consistently connects performance with identity, ambition, and self-expression. This emotional attachment strengthens brand loyalty, supports premium pricing, and makes Nike less vulnerable to short-term trend cycles than purely functional competitors.

Athlete Endorsements & Marketing Engine

Nike’s marketing engine is built around strategic, long-term partnerships with elite athletes and teams, transforming individual endorsements into scalable brand platforms. Signature athletes are not treated as short-term marketing assets but as enduring franchises that generate returns across footwear, apparel, and lifestyle categories. This approach delivers compounding ROI, as athlete narratives evolve over time and reinforce Nike’s authenticity, credibility, and cultural leadership across global sports.

Innovation & Product Design

Innovation remains central to Nike’s competitive advantage. The company has developed a portfolio of proprietary technologies, including Air cushioning, Flyknit construction, React foam, and ZoomX, which enhance performance while enabling distinctive design language. These platforms are continually refined and applied across multiple categories, extending their commercial lifespan. Nike’s sustained investment in research and development ensures a steady pipeline of performance-driven products, reinforcing differentiation in both elite athletics and everyday wear.

Competitive Advantage & Moat

Scale & Supply Chain Efficiency

Nike’s global scale underpins a powerful operational moat. The company leverages an extensive network of manufacturing partners across multiple countries, allowing it to source at scale, manage costs, and adjust production in response to regional demand shifts. This diversified supply chain reduces reliance on any single geography while supporting consistent product quality and speed to market. Nike’s scale also enables more sophisticated inventory management and logistics capabilities, helping the company balance global distribution with localized assortment planning and demand forecasting.

Direct-to-Consumer Strategy

Nike’s direct-to-consumer strategy strengthens both margins and brand control. By selling through owned retail stores and digital platforms, Nike captures higher gross margins compared to wholesale channels while maintaining tighter control over pricing, presentation, and consumer experience. Direct channels also provide access to rich customer data, enabling personalized marketing, targeted product launches, and more efficient inventory allocation. Over time, this data-driven approach increases customer lifetime value and enhances Nike’s ability to respond quickly to changing consumer preferences.

Network Effects & Brand Loyalty

Nike benefits from strong network effects rooted in brand loyalty and community engagement. Its ecosystem of membership programs and digital apps fosters repeat engagement by integrating products with training, performance tracking, and content. As consumers deepen their participation in Nike’s community, switching costs rise, not because of contractual lock-in, but due to emotional attachment, habit formation, and identity alignment with the brand. This loyalty reinforces demand stability and supports Nike’s long-term competitive advantage.

Financial Performance

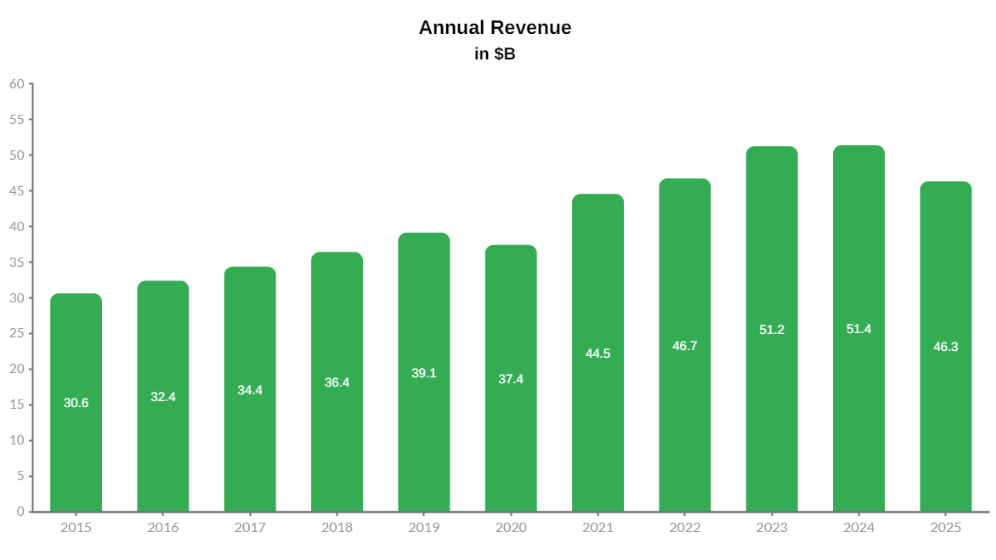

10-Year Revenue Trend (2015–2025)

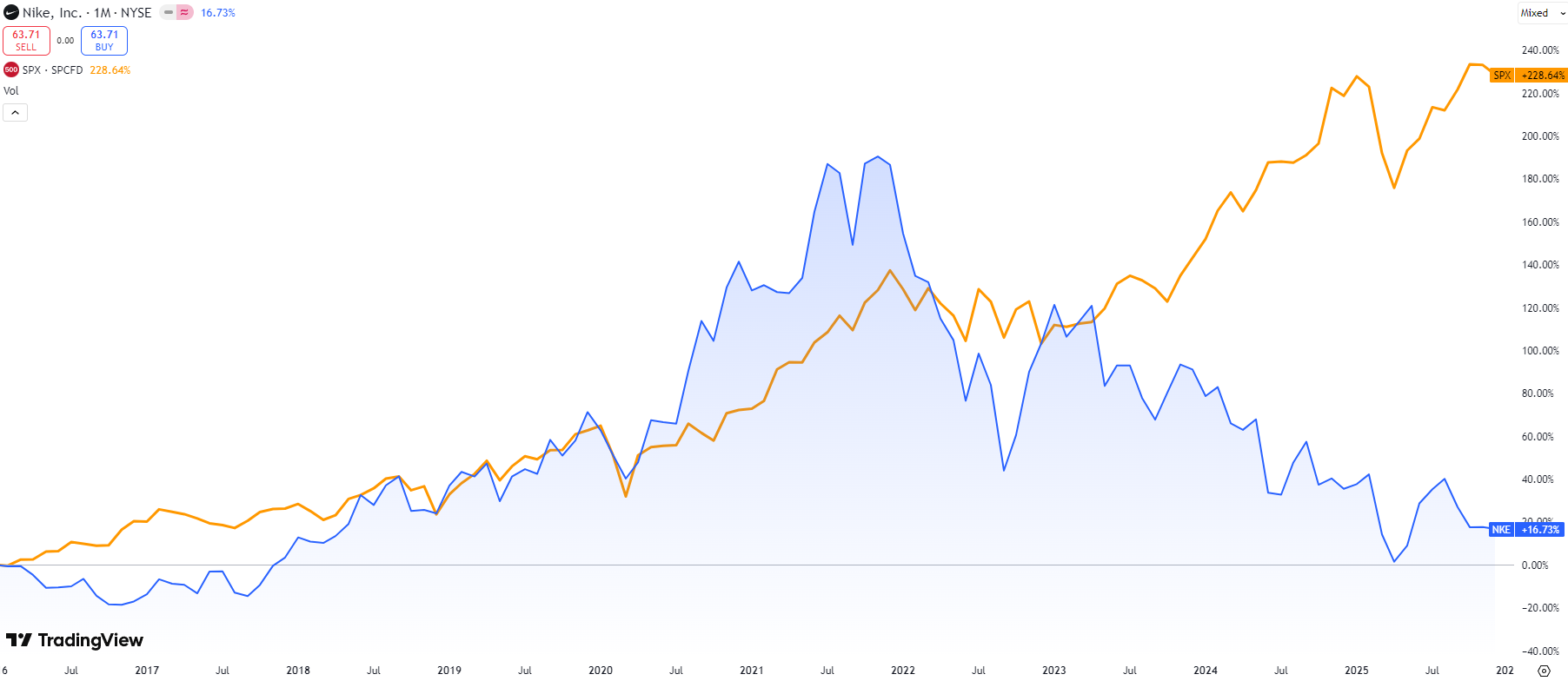

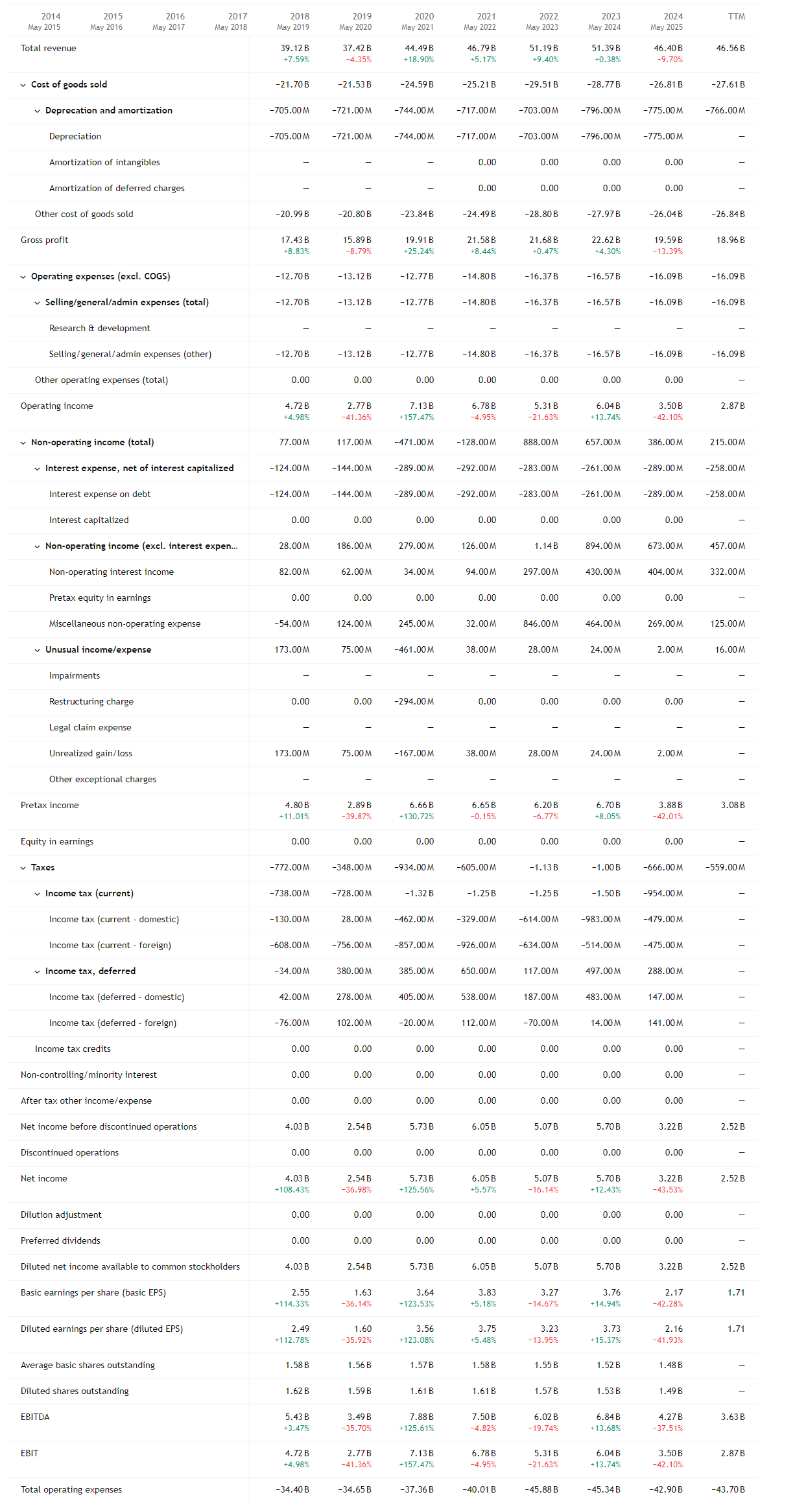

Over the past decade, Nike’s revenue trajectory reflects a structurally growing global brand, punctuated by cyclical disruptions and more recent normalization. From fiscal 2015 through 2019, Nike delivered steady, consistent top-line growth, expanding from roughly $31 billion to $39 billion as global sports participation rose, international markets scaled, and athleisure moved firmly into the mainstream. This period highlighted Nike’s ability to compound growth through brand strength, product innovation, and geographic expansion.

Fiscal 2020 marked a clear break in the trend, with revenues declining as the COVID-19 pandemic disrupted global supply chains, shuttered retail stores, and temporarily reduced consumer demand. This decline was cyclical rather than structural. Nike rebounded sharply in fiscal 2021 and continued to grow through fiscal 2022 and 2023, supported by digital acceleration, pent-up consumer demand, and pricing actions. By fiscal 2023 and 2024, revenues reached a peak of just over $51 billion, though growth had already begun to decelerate, signaling a transition from recovery-driven expansion to a more mature growth phase.

The limited revenue growth between fiscal 2023 and fiscal 2024 reflects this normalization. Demand stabilized after post-pandemic surges, while competitive intensity increased and promotional activity rose across the industry. Nike remained large and resilient, but incremental growth became harder to achieve at scale, particularly in mature markets such as North America.

Fiscal 2025 saw a notable revenue decline, reversing the prior upward trend. This pullback was driven primarily by softer demand across key regions, including North America, EMEA, and Greater China, alongside deliberate strategic adjustments. Higher promotional activity, increased discounting, and shifts in channel mix pressured reported revenues, while Nike also faced challenges in digital sales momentum and wholesale ordering patterns. Importantly, this decline reflects a combination of macroeconomic headwinds, consumer caution, and internal reset efforts rather than a deterioration of brand relevance.

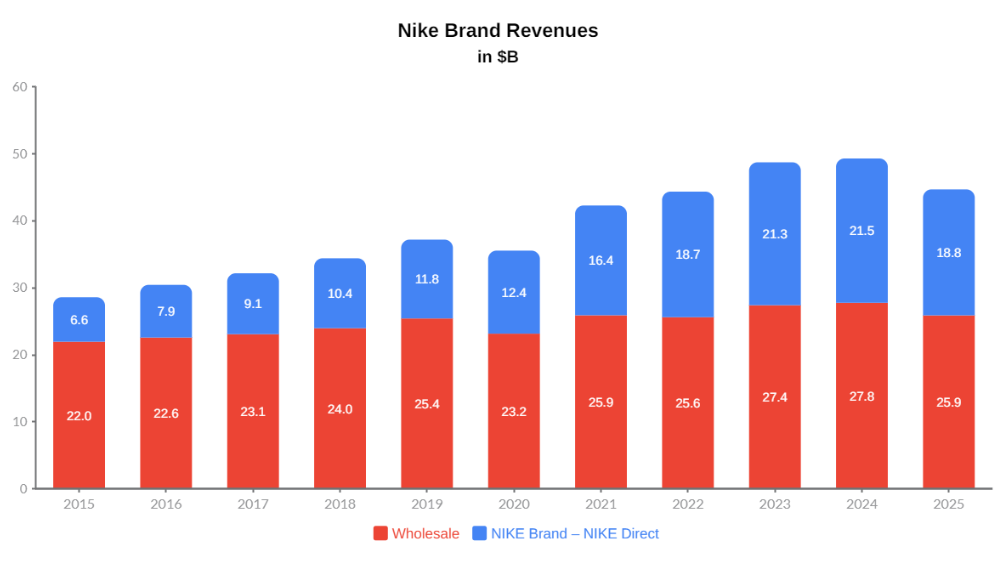

Nike Brand Revenue

Over the past decade, Nike Brand revenues have broadly tracked the same trajectory as total Nike, Inc. revenues, reflecting the brand’s central role in the company’s overall performance. From fiscal 2015 through 2019, Nike Brand revenues expanded steadily, supported by rising global sports participation, growing lifestyle adoption, and increasing scale across both wholesale and direct-to-consumer channels. This upward trend was interrupted in fiscal 2020 due to pandemic-related disruptions, followed by a strong rebound beginning in 2021 as demand normalized and digital channels accelerated.

Growth remained positive through fiscal 2024, although the pace of expansion moderated. While revenues reached new highs in 2023 and 2024, gains during this period were less pronounced compared to earlier years, reflecting a maturing demand environment, elevated promotional activity, and normalization following post-pandemic pull-forward effects. In fiscal 2025, Nike Brand revenues declined meaningfully, marking the most notable downturn since 2020.

Revenue Mix by Channel

Nike Brand revenue is generated across three channels: Wholesale, NIKE Direct, and Global Brand Divisions.

Wholesale is the largest and most established contributor to Nike Brand revenue. It represents sales to third-party retailers such as sporting goods stores, athletic specialty retailers, department stores, and category-specific outlets. Wholesale has historically driven scale and global reach, enabling Nike to distribute large volumes of product efficiently across diverse markets. Over the past decade, wholesale revenue grew steadily through 2019, dipped in 2020, and recovered through 2024. Despite Nike’s strategic emphasis on direct-to-consumer, wholesale remains dominant due to its ability to move high volumes, particularly in regions where owned retail and digital penetration are lower. However, wholesale is more sensitive to inventory cycles and promotional pressure, which contributed to softness in fiscal 2025 as retailers reduced orders amid weaker consumer demand.

NIKE Direct includes sales through Nike-owned retail stores, Nike.com, and digital apps. Over the last ten years, this channel has been the fastest-growing component of Nike Brand revenue, expanding consistently from 2015 through its peak in 2024. Direct growth reflects Nike’s long-term strategy to improve margins, control brand presentation, and deepen consumer relationships through data and digital engagement. The pandemic accelerated this shift, with digital sales driving much of the post-2020 recovery. However, NIKE Direct revenues also declined in fiscal 2025, driven by weaker digital traffic, lower conversion, and a pullback following several years of elevated growth.

Global Brand Divisions represent licensing and other centrally managed Nike Brand revenues that are not allocated to specific geographic segments. While part of the Nike Brand, this category contributes only a negligible share of total revenue, declining from approximately $0.1 billion in 2015 to about $0.05 billion in 2025. Its small size reflects Nike’s preference for direct brand control rather than extensive licensing, as well as the non-core nature of these revenue streams. Although high-margin, Global Brand Divisions are not a material driver of overall performance.

2025 Decline and Key Takeaways

The decline in Nike Brand revenue in fiscal 2025 reflects a combination of factors rather than a structural erosion of demand. These include higher promotional activity and discounting, inventory rebalancing across wholesale partners, softer consumer spending in key regions, and normalization following several years of accelerated growth. Importantly, the downturn affected both wholesale and direct channels, underscoring the cyclical nature of demand rather than a failure of Nike’s channel strategy.

Overall, the ten-year Nike Brand revenue trend highlights a business that has successfully scaled through a dual-channel model, with wholesale providing global reach and NIKE Direct driving long-term margin and brand strength. While fiscal 2025 represents a period of reset, the underlying channel mix and brand fundamentals remain intact, positioning Nike Brand for more sustainable growth once macro and inventory pressures ease.

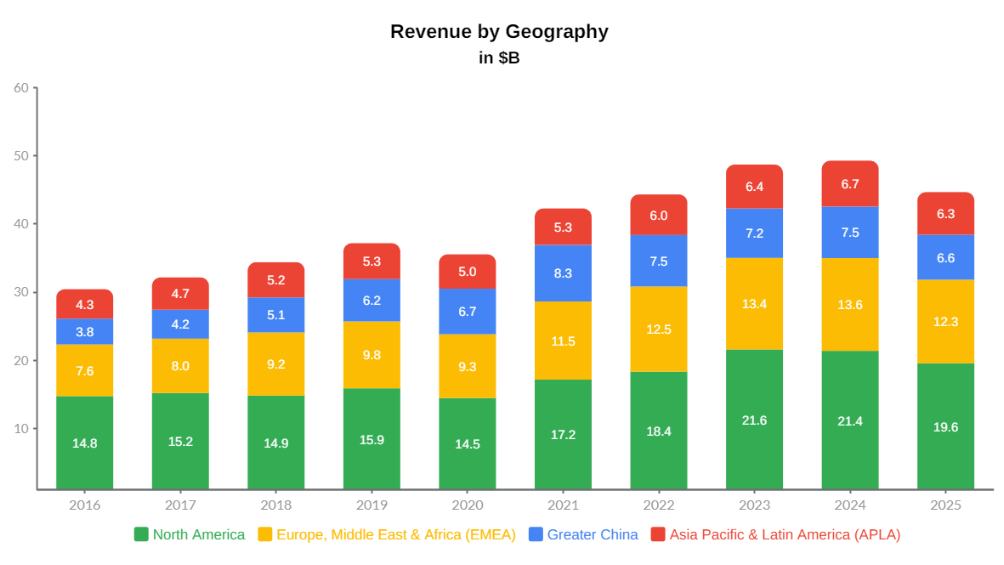

Revenue by Geography

Nike’s revenue by geography from fiscal 2016 to 2025 highlights the company’s globally diversified footprint, with distinct regional growth cycles and varying sensitivity to macroeconomic conditions. While the mix has shifted over time, no single region dominates growth exclusively, reinforcing Nike’s position as a truly global consumer brand.

North America

North America remains Nike’s largest revenue contributor throughout the period, reflecting the brand’s deep penetration, strong wholesale partnerships, and mature direct-to-consumer ecosystem. Revenues grew steadily from 2016 through 2019, dipped in 2020 amid pandemic disruptions, and rebounded sharply between 2021 and 2023 as consumer demand normalized and digital channels scaled.

Growth plateaued in 2024 and declined in 2025, indicating demand normalization, higher promotional intensity, and softer discretionary spending in a mature market. As Nike’s most developed region, North America tends to reflect broader consumer cycles earlier than other geographies, making it both a stabilizing base and a leading indicator for global trends.

Europe, Middle East & Africa (EMEA)

EMEA shows a consistent long-term upward trend, interrupted briefly in 2020 before accelerating from 2021 through 2024. The region benefited from expanding sports participation, lifestyle adoption, and a growing direct-to-consumer presence across major European markets.

The decline in 2025 mirrors pressures seen elsewhere, including inventory adjustments and cautious consumer spending, but EMEA remains one of Nike’s most structurally attractive regions due to its size, brand strength, and long-term growth potential relative to North America.

Greater China

Greater China stands out as Nike’s most volatile major geography over the period. Revenues expanded strongly from 2016 to 2019, followed by a sharp disruption in 2020. While the region recovered in subsequent years, growth has been uneven and more muted compared to other markets.

From 2023 to 2025, Greater China experienced a renewed slowdown, reflecting a combination of macroeconomic softness, changing consumer preferences, heightened local competition, and brand recalibration. Despite near-term pressure, Greater China remains strategically important given its scale and long-term consumer growth potential.

Asia Pacific & Latin America (APLA)

APLA represents Nike’s fastest-growing emerging-market cluster, albeit from a smaller base. Revenues increased steadily from 2016 through 2019, rebounded strongly post-2020, and continued growing through 2024. The region benefits from rising middle-class incomes, increasing sports participation, and expanding digital access.

The modest pullback in 2025 reflects broader global pressures rather than region-specific weakness. Over the long term, APLA remains a key source of incremental growth and diversification.

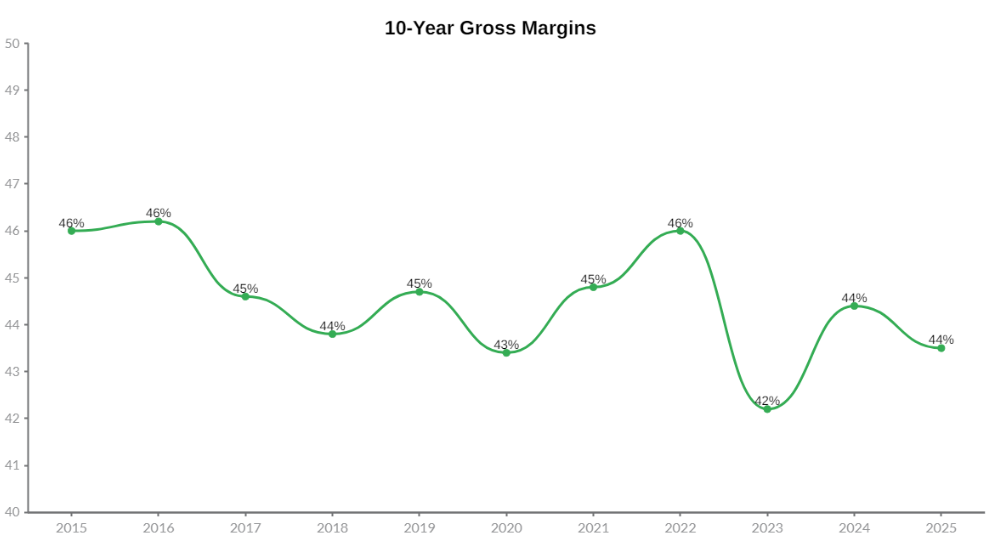

Gross Margin Analysis

Gross margin is a critical metric in evaluating Nike’s business quality because it reflects pricing power, brand strength, cost discipline, and channel mix, not just top-line growth. Unlike revenue, which can be influenced by volume and promotions, gross margin reveals how efficiently Nike converts sales into profit after accounting for product costs, discounts, logistics, and currency effects. For a global consumer brand like Nike, sustained margins signal competitive advantage and long-term earnings durability.

10-Year Gross Margin Trend (2015–2025)

Over the past decade, Nike’s gross margin has generally fluctuated within a mid-40% range, underscoring the brand’s historically strong pricing power and premium positioning. Margins were strongest in periods where demand was healthy, inventory was well balanced, and direct-to-consumer penetration increased.

- 2015–2016: Margins peaked around 46%, supported by strong brand momentum and favorable cost dynamics.

- 2017–2020: Margins softened into the low-to-mid 40s due to rising costs, supply chain pressures, and pandemic-related disruptions.

- 2021–2022: A recovery phase, with margins rebounding toward 46% as demand normalized and digital channels scaled.

Sharp Decline in 2023

The most notable margin compression occurred in fiscal 2023, when gross margin declined sharply to approximately 43.5%, a drop of 250 basis points year-over-year. This decline was primarily driven by:

- Higher product costs, reflecting lingering supply chain inefficiencies and inflationary pressures

- Increased markdowns, as Nike worked through elevated inventory levels

- Unfavorable foreign currency exchange rates, which pressured reported margins

These headwinds were only partially offset by strategic pricing actions, highlighting the limits of pricing power during periods of inventory imbalance and macro uncertainty.

Continued Pressure in 2025

Gross margin declined again in fiscal 2025, falling 190 basis points to 42.7%, marking one of the lower points in the decade. The drivers differed slightly but remained operational in nature:

- Higher discounts, reflecting a more promotional environment

- Unfavorable changes in channel mix, including pressure within direct-to-consumer and wholesale dynamics

- Higher inventory obsolescence reserves, tied to product aging and demand recalibration

These factors were partially offset by lower product costs, suggesting that supply-side pressures are easing even as demand-side adjustments continue.

Key Takeaways

- Nike’s margin pressure in recent years is cyclical rather than structural, driven largely by inventory management, promotions, and macro factors rather than brand erosion.

- The long-term margin range still reflects strong underlying pricing power, especially compared to broader apparel peers.

- Future margin recovery will depend on inventory normalization, reduced discounting, and a healthier channel mix, particularly as direct-to-consumer execution stabilizes.

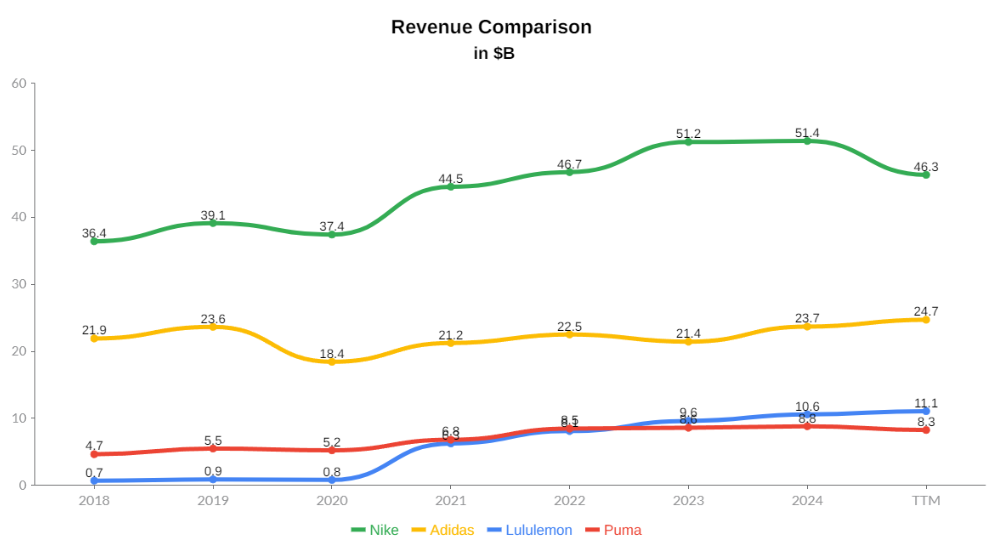

Competitive Landscape and Peer Comparison

Nike operates in a highly competitive global athletic footwear and apparel market, facing pressure from both large-scale sportswear rivals and premium, direct-to-consumer–focused brands. Comparing Nike with Adidas, Lululemon, and Puma captures the most relevant dimensions of competition across scale, innovation execution, pricing power, and profitability, rather than forcing a narrow, one-dimensional peer set.

Peer Selection Rationale

Adidas is Nike’s closest like-for-like competitor, competing directly across footwear, apparel, athlete endorsements, and global sports marketing. Its scale and category overlap make it the most relevant benchmark for global reach and market share leadership.

Lululemon represents a different but increasingly important form of competition. It does not compete on volume or multi-sport breadth, but instead pressures Nike on premium pricing, margins, and direct-to-consumer execution, particularly within lifestyle and athleisure segments.

Puma serves as a challenger brand, operating at a smaller global scale while competing in both performance and lifestyle categories. Its strategy relies on agility, selective endorsements, and regional strengths rather than broad category dominance.

Together, these peers reflect Nike’s competitive pressures across volume leadership, profitability, and innovation speed, offering a more complete picture of its operating environment.

Market Share and Scale

Nike remains the global market leader in athletic footwear and apparel, with a materially larger market share than both Adidas and Puma, particularly in footwear. This scale advantage is most pronounced in North America, where Nike’s brand dominance, wholesale relationships, and direct-to-consumer ecosystem are difficult to replicate.

Adidas maintains strong positions in Europe and football-driven categories, while Puma operates at a smaller scale with selective strength in lifestyle segments and specific regions. Lululemon does not compete on overall market share, but commands a meaningful presence in premium athleisure, especially in North America, supported by a loyal and high-spending consumer base.

Brand Strength and Innovation Execution

Nike’s brand strength is unmatched, built on decades of athlete endorsements, cultural relevance, and global storytelling. This scale provides durability and long-term relevance, though it can slow execution during periods of strategic transition.

Adidas has demonstrated faster innovation cycles in certain periods, particularly through lifestyle collaborations and sustainability-led initiatives. Lululemon stands out for product-led innovation, iterating quickly on fabrics, fit, and performance apparel, often bringing refined products to market faster than Nike in core apparel categories. Puma competes through agility and trend responsiveness, but lacks Nike’s depth across sports science, performance technology, and multi-sport platforms.

Further Reading

The following sources provide additional context on peer performance, regional strength, and premium positioning within the global athletic and athleisure market.

Adidas Group Press Release: FY2024 Results and 2025 Outlook

https://www.adidas-group.com/en/media/press-releases/adidas-reports-strong-results-for-2024-and-expects-top-and-bottom-line-momentum-to-continue-in-2025

Discusses Adidas’s recent financial performance, category-level growth drivers, and continued strength in Europe and football-driven segments.

Lululemon 2024 Annual Report

https://corporate.lululemon.com/~/media/Files/L/Lululemon/investors/annual-reports/lululemon-2024-annual-report.pdf

Provides insight into Lululemon’s premium positioning, revenue growth, margin profile, direct-to-consumer strategy, and concentration in North America.

Pricing Power, Margins, and Revenue Dynamics

Nike demonstrates strong long-term pricing power supported by brand equity and global demand, though recent margin pressure highlights its exposure to promotions and inventory cycles at scale. Lululemon is the clear margin leader among peers, benefiting from premium positioning, disciplined inventory management, and a highly efficient direct-to-consumer model.

Adidas operates with thinner margins than Nike, reflecting greater exposure to wholesale channels and regional volatility, while Puma’s margins remain more constrained due to competitive pricing and smaller scale.

Revenue comparison provides important context for competitive scale, strategic flexibility, and resilience. Nike’s significantly larger revenue base enables sustained investment in innovation, marketing, athlete partnerships, and global infrastructure. While revenue alone does not capture profitability, it establishes the foundation for brand reach and long-term competitive advantage in a capital-intensive consumer business.

Revenue Trends and Competitive Implications

The revenue comparison highlights a clear hierarchy:

- Nike remains far ahead, with revenue more than double Adidas and many multiples larger than Lululemon and Puma. Despite a recent pullback, its scale advantage remains intact.

- Adidas consistently ranks second, though growth has been uneven due to restructuring efforts, regional pressures, and reliance on wholesale-heavy channels.

- Lululemon has outpaced Puma in recent years, driven by premium pricing, disciplined inventory management, and strong direct-to-consumer execution.

- Puma’s growth has been more modest, reinforcing its position as a challenger rather than a category leader.

Lululemon’s growth does not threaten Nike’s leadership in footwear or global sportswear scale, but it is strategically relevant. It raises the benchmark for margins, pricing discipline, and DTC execution, areas where Nike competes less on volume and more on profitability, brand engagement, and lifestyle relevance.

Nike’s competitive advantage lies in its ability to combine unmatched scale, brand dominance, and category breadth. While peers may outperform Nike in specific areas, such as Lululemon in margins, Adidas in select innovation cycles, or Puma in agility, none currently match Nike’s ability to compete simultaneously on global reach, cultural relevance, and long-term earnings power.

Leadership & Management

Nike’s long-term growth has been shaped by a leadership team deeply rooted in the company’s culture, with decades of internal experience across product, brand, commercial execution, and global markets. This continuity has helped Nike scale from a performance footwear company into a global, multi-category consumer brand while preserving its innovation-led identity.

Philip Knight – Chairmain Emeritus

Phil Knight led the company from a small partnership founded on a handshake to the world’s largest athletic footwear, apparel, and equipment company. Serving as President from 1968 to 1990 and again from 2000 to 2004, Knight was instrumental in scaling Nike’s global operations, establishing its athlete-driven brand strategy, and instilling a disciplined yet entrepreneurial growth culture. His background as a certified public accountant, business professor, and Stanford MBA shaped Nike’s long-term, performance-oriented approach to innovation and brand investment that continues to influence the company today.

Mark Parker – Executive Chairman

Mark Parker has been one of the most influential figures in Nike’s modern history. Having joined the company in 1979 and served as CEO from 2006 to 2020, Parker played a central role in transforming Nike into a design- and innovation-driven brand with deep cultural relevance. His leadership oversaw the expansion of Nike’s product innovation engine, the strengthening of athlete-led storytelling, and the global scaling of the Nike Brand. Parker’s background in product design and development embedded innovation at the core of Nike’s strategy, helping the company sustain premium positioning and long-term brand equity. As Executive Chairman, he continues to provide strategic continuity and brand stewardship.

Elliott Hill – President & Chief Executive Officer

Elliott Hill brings more than three decades of Nike experience across sales, retail, and global markets. His career spans leadership roles in Europe, North America, and global commercial operations, culminating in his appointment as CEO in 2024. Hill has been instrumental in scaling Nike’s marketplace execution, strengthening retail and wholesale partnerships, and aligning marketing with consumer demand. His leadership reflects Nike’s renewed emphasis on disciplined execution, consumer focus, and balanced growth across wholesale and direct-to-consumer channels.

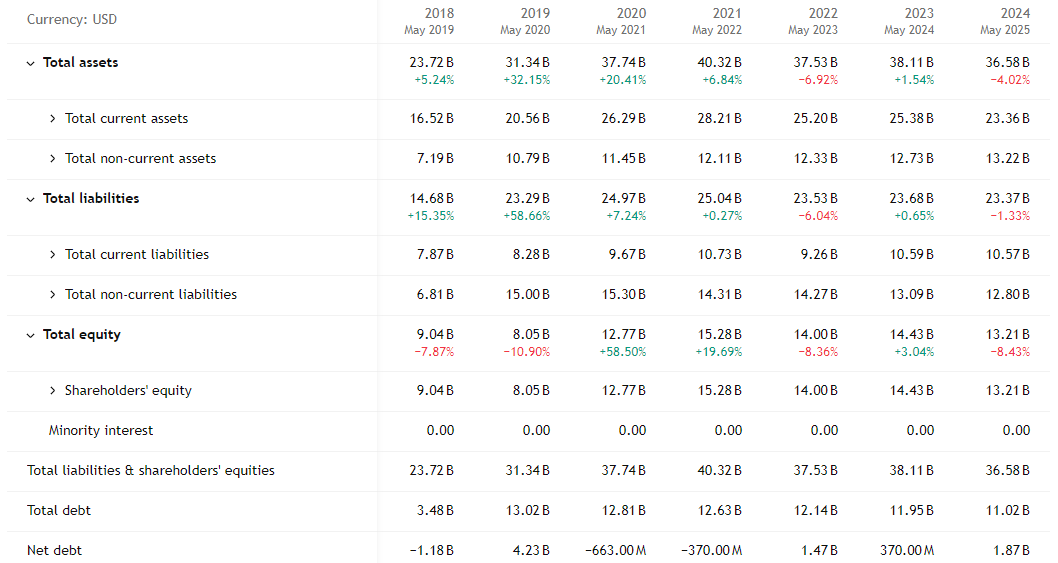

Matthew Friend – Executive Vice President & Chief Financial Officer

Matthew Friend has played a key role in strengthening Nike’s financial discipline and strategic planning. Since becoming CFO in 2020, he has overseen capital allocation, margin management, and long-term financial strategy during a period of heightened volatility across global supply chains and consumer demand. With prior experience in investment banking and deep familiarity with Nike’s brand economics, Friend has helped guide Nike’s transition toward a more data-driven, consumer-direct business while maintaining balance sheet strength.

Rob Leinwand – Executive Vice President & Chief Legal Officer

Rob Leinwand has been central to strengthening Nike’s governance, risk management, and brand protection as the company operates at global scale. His oversight across legal, public affairs, and resilience functions supports Nike’s ability to navigate regulatory complexity, protect intellectual property, and manage geopolitical and supply chain risks, all of which are increasingly important to sustaining long-term growth.

Ann Miller – Executive Vice President, Global Sports Marketing

Ann Miller leads Nike’s athlete, league, and team partnerships worldwide. She plays a central role in translating Nike’s innovation and product strategy into cultural relevance through elite athlete endorsements and global sporting events. Under her leadership, sports marketing continues to function as a core growth engine, reinforcing Nike’s authenticity, storytelling power, and connection to athletes across performance and lifestyle categories.

Craig Williams – Executive Vice President and Chief Commercial Officer

Craig Williams oversees Nike’s global commercial operations, including geographic units, direct-to-consumer channels, and wholesale partnerships. His role is critical in aligning brand strategy with execution across markets, optimizing channel mix, and driving revenue growth at scale. Williams’ leadership supports Nike’s transition toward a more integrated, consumer-centric commercial model while maintaining global reach and operational discipline.

Overall, Nike’s leadership team combines long-tenured internal expertise with operational and financial discipline, reinforcing the company’s ability to innovate, scale globally, and adapt to shifting consumer and market dynamics. This depth of experience supports Nike’s long-term strategy of brand-led growth, margin expansion through direct-to-consumer channels, and sustained cultural relevance.

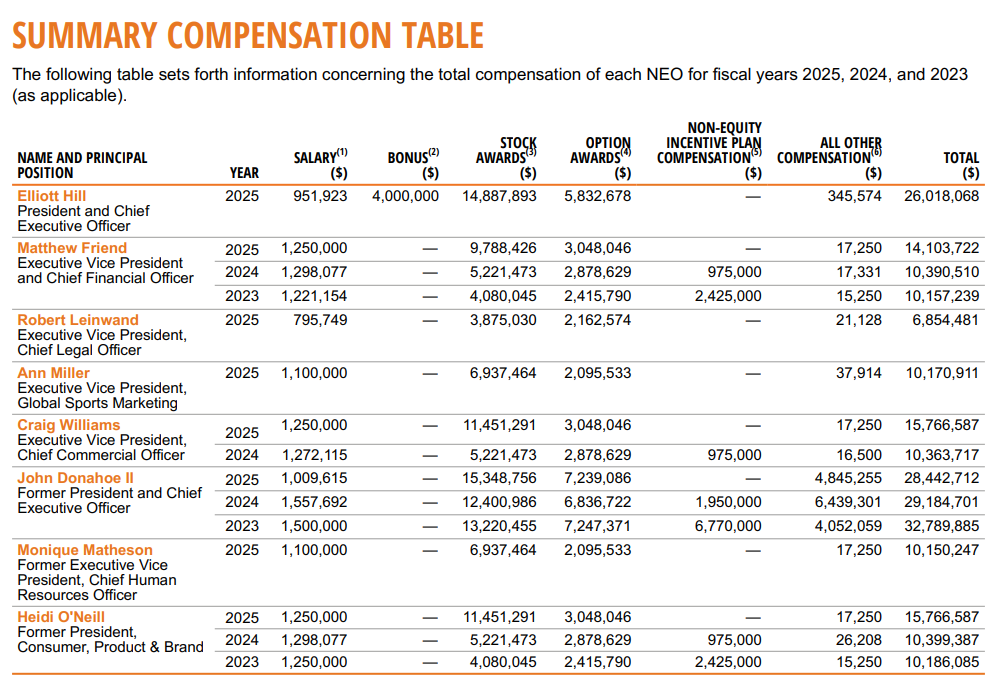

Executive Compensation Overview

Nike’s executive compensation structure reflects a pay-for-performance philosophy designed to align leadership incentives with long-term shareholder value creation. Compensation is heavily weighted toward equity-based awards, reinforcing management’s focus on sustained brand strength, earnings power, and strategic execution rather than short-term results. This approach is consistent with Nike’s emphasis on long-term innovation, global scale, and durable competitive advantage.

Key Observations from the Compensation Table

Across senior executives, base salaries represent a relatively modest portion of total compensation, while stock awards and option awards account for the majority of pay. For fiscal 2025, this structure is particularly evident for senior leadership, including the President and CEO, Chief Financial Officer, Chief Commercial Officer, and Global Sports Marketing head, where equity compensation materially exceeds cash salary. This design directly links executive wealth creation to Nike’s share price performance and long-term value creation.

Bonuses are selective and not uniformly applied, underscoring Nike’s preference for long-term incentives over short-term cash payouts. Non-equity incentive plan compensation appears primarily in prior fiscal years for certain roles, reflecting performance-based outcomes tied to specific operating or strategic targets rather than recurring entitlements.

Cohort-Based and Role-Aligned Compensation

Nike also employs a cohort approach to executive compensation, aligning pay across comparable leadership roles to promote internal equity and teamwork. This is reflected in the similar compensation structures among senior executives, particularly in stock and option award levels. The approach reduces internal competition for pay outcomes and reinforces collective accountability for company-wide performance.

Governance and Shareholder Alignment

Nike’s compensation framework is further supported by shareholder engagement. The company considers feedback from its annual say-on-pay vote, which received approximately 83% shareholder approval, indicating broad investor support for the structure and incentive design. This level of approval suggests confidence that executive compensation outcomes are reasonably aligned with Nike’s long-term strategy, performance trajectory, and governance standards.

Overall, Nike’s executive compensation structure prioritizes long-term equity incentives, internal alignment, and shareholder interests. While total compensation levels are substantial, they are closely tied to stock-based rewards and performance outcomes, reinforcing management accountability for executing Nike’s long-term growth strategy and navigating cyclical pressures in a highly competitive global market.

Risks & Key Considerations

Nike operates a global, brand-driven consumer business, which exposes it to a wide range of strategic, operational, and macroeconomic risks. While the company benefits from scale, brand strength, and diversification, these risks can materially affect revenue growth, margins, cash flows, and valuation over time.

Macroeconomic & Consumer Demand Risk

Nike’s products are discretionary in nature, making demand sensitive to global economic conditions. Periods of inflation, high interest rates, or recession can reduce consumer spending, leading to lower sales, higher promotional activity, inventory build-ups, and margin pressure. Weak retail environments can also strain wholesale partners, resulting in order cancellations, delayed payments, or retailer bankruptcies that negatively impact Nike’s revenue and cash flow.

Competitive Intensity & Brand Relevance

The global athletic footwear and apparel market is intensely competitive, with pressure coming from established global brands, fast-moving challengers, private labels, and digitally native players. Nike competes across product innovation, pricing, endorsements, marketing spend, digital experience, and speed to market. Failure to anticipate consumer preferences, fashion trends, or shifts in sports popularity could result in excess inventory, markdowns, and erosion of brand momentum. Maintaining cultural relevance, especially among younger consumers, remains critical to sustaining long-term demand.

Innovation, Product Execution & Endorsement Risk

Nike’s success depends heavily on continuous innovation and product differentiation. New product launches may fail to resonate with consumers or may require higher-than-expected marketing and development costs. The company also relies on high-profile athletes, teams, and cultural figures to reinforce brand authenticity. Increased competition for endorsements, reputational issues involving endorsers, or failure to secure influential partnerships could weaken Nike’s marketing effectiveness and brand perception.

Supply Chain & Manufacturing Risk

Nike relies on a concentrated network of third-party manufacturers, primarily located outside the United States. Disruptions related to geopolitical tensions, trade restrictions, tariffs, labor issues, pandemics, natural disasters, or transportation constraints could delay production or delivery, increase costs, or limit product availability. Rising costs for raw materials, labor, energy, or freight may compress margins if not offset through pricing or efficiency gains.

Inventory Management & Forecasting Risk

Accurately forecasting consumer demand is challenging due to long lead times, seasonal demand patterns, and rapidly changing preferences. Overestimating demand can lead to excess inventory, markdowns, and brand dilution, while underestimating demand can result in lost sales and strained retailer and consumer relationships. These dynamics can cause significant volatility in quarterly results and cash flow.

Direct-to-Consumer & Digital Execution Risk

Nike has made significant investments in its direct-to-consumer and digital platforms, which carry high fixed costs and execution risk. Shifts away from physical retail, underperformance of flagship stores, or poor digital experiences could impair returns on these investments. Nike’s digital platforms must remain secure, reliable, and user-friendly amid rising cybersecurity threats and increasing consumer expectations. Failures in technology systems, data security breaches, or inability to scale digital infrastructure could damage trust and disrupt operations.

Foreign Exchange & Global Operations Risk

With a majority of revenue generated outside the United States, Nike is exposed to foreign currency fluctuations, inflationary pressures, and political and economic instability across multiple regions. A stronger U.S. dollar can reduce reported international revenue and earnings, while volatility in exchange rates can also disrupt supplier economics and pricing strategies. Trade policy changes, tariffs, sanctions, and regulatory divergence across jurisdictions add complexity and cost to global operations.

Climate, Sustainability & Regulatory Risk

Nike faces growing exposure to climate change risks, including extreme weather events that may disrupt manufacturing, logistics, retail traffic, or consumer demand. At the same time, evolving sustainability regulations and stakeholder expectations increase compliance costs and operational complexity. Failure to meet environmental, social, or governance expectations or perceived missteps in these areas could result in reputational damage, reduced demand, or regulatory penalties.

Legal, Compliance & Data Privacy Risk

As a global consumer brand, Nike operates under a complex regulatory environment spanning labor laws, trade compliance, intellectual property protection, data privacy, taxation, and anti-corruption regulations. Litigation, regulatory investigations, data privacy violations, or failures to protect intellectual property could result in financial penalties, operational disruption, or reputational harm. Increasing use of digital platforms and AI tools also introduces new legal and data security considerations.

Talent, Culture & Leadership Risk

Nike’s performance depends on its ability to attract, retain, and motivate creative, technical, and operational talent. Heightened competition for skilled employees, changes in workplace expectations, or damage to corporate culture could weaken execution and innovation capacity. Public scrutiny of leadership decisions, culture, or values could also affect employee engagement and brand perception.

The Long Game

Nike’s story has never been about short-term wins—it has always been about endurance. From its roots in performance innovation to its evolution as a global cultural force, Nike has built a business that lives at the intersection of sport, identity, and aspiration. Few brands can claim the same emotional resonance across generations, geographies, and lifestyles, and even fewer have successfully converted that relevance into sustained global scale.

Recent headwinds—margin compression, inventory resets, and uneven revenue growth—reflect the realities of operating at Nike’s size rather than a breakdown of its core strengths. These challenges are cyclical, not existential. The fundamentals that made Nike dominant remain firmly in place: unmatched brand equity, an asset-light and flexible supply chain, a powerful direct-to-consumer ecosystem, and a loyal global community that continues to choose Nike not just for performance, but for what the brand represents.

When viewed alongside peers, Nike’s advantage becomes clearer. Competitors may move faster in select niches or post higher margins in narrower categories, but none rival Nike’s ability to compete simultaneously on scale, cultural relevance, innovation, and reach. This balance gives Nike resilience—and the optionality to adapt as consumer behavior, technology, and sport itself continue to evolve.

For long-term investors, Nike is not a short sprint; it is a marathon. As execution improves and operational pressures ease, the company is well positioned to turn its enduring brand power into renewed growth and compounding shareholder value. In the world of consumer brands, Nike remains one of the few built not just to win today—but to keep winning over time.

🔗 Learn more about our long-term investing philosophy at Snowball Investing.

🔗 Explore how Nike can anchor long-term portfolio growth in The Essentials of Snowball Investing.

🔗 Browse our curated list of recommended investing books.

🎧 Listen to the Snowball Investing Podcast for audio versions of our featured articles.

The following data snapshots are as of 1/1/2026 from tradingview website

Key Stats

Performance

Financial Statements

Income Statement

Balance Sheet

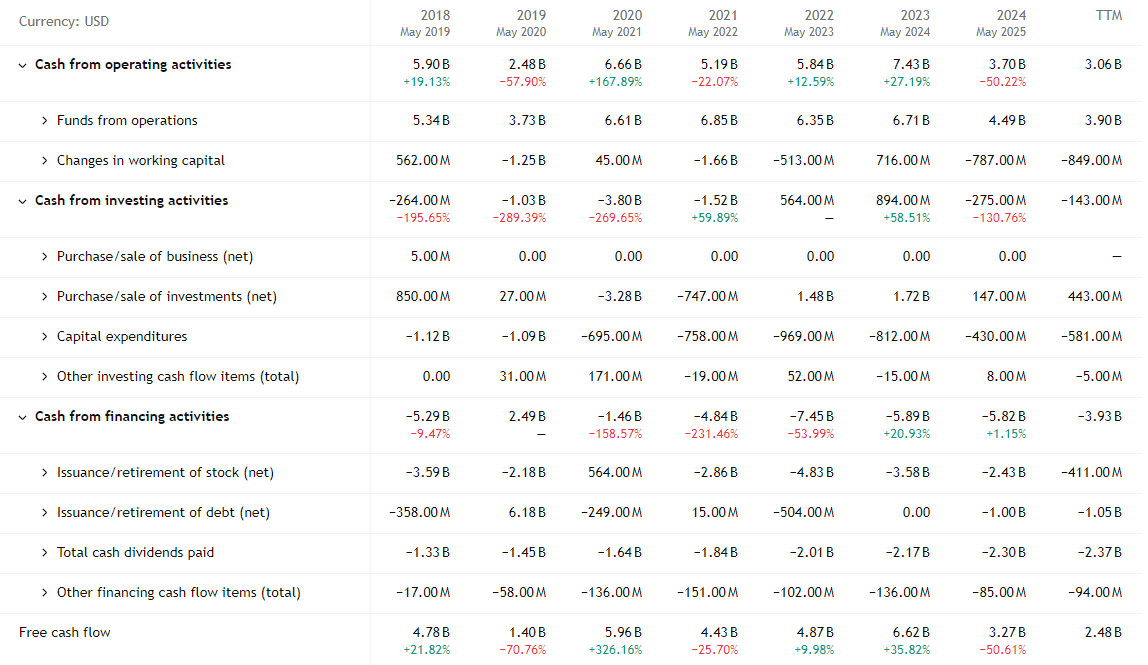

Cash Flow

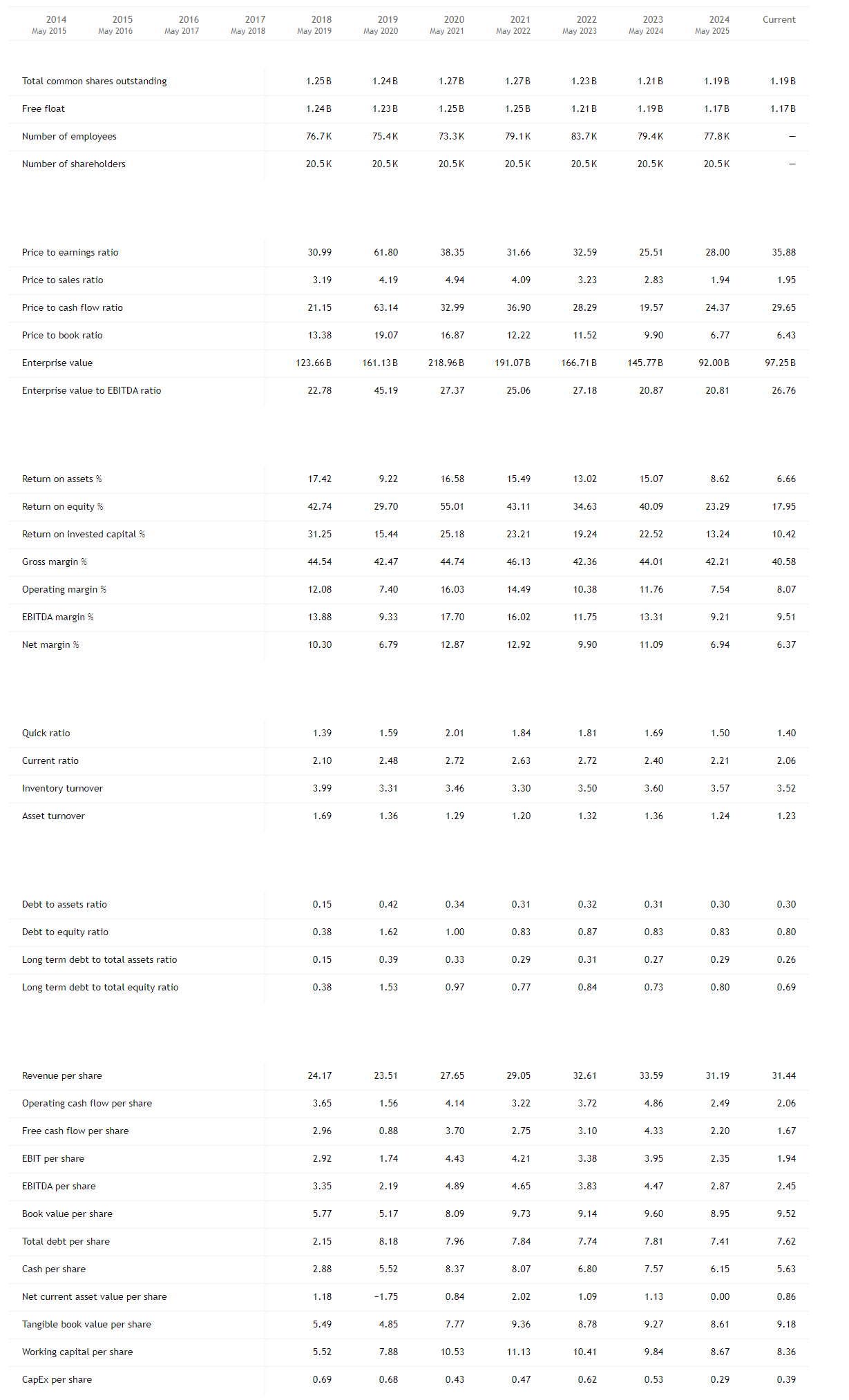

Statistics

Sources: Google Doc

Unlock the power of compounding

We are changing the way that people build wealth. If your portfolio is performing below S&P 500 in the last 5 years, then you need to subscribe here. Discover remarkable stories directly to your inbox. As a subscriber, you'll receive the valuable recommendation of an exceptionally outstanding company that are designed to help you build wealth.

Gain access to exclusive benefits by subscribing today!

Disclaimer: Please note that this newsletter is a financial information publisher and not an

investment advisor. Subscribers should not view this newsletter as offering personalized legal or investment

counseling. Investors should consult with their investment advisor and review the prospectus or financial / stock

recommendation of the issuer in question before making any investment decisions. All articles, blogs, comments,

emails, and chatroom contributions - even those including the word "recommendation" - should never be construed as

official business recommendations or advice. Liability of all investment decisions resides with the individual

investor.

Snowball Investing does not provide any guarantees, warranties, or representations, whether explicitly or

implicitly, regarding the accuracy, reliability, completeness, or reasonableness of the information presented. The

opinions, assumptions, and estimates expressed represent the author's viewpoints as of the publication date and are

subject to modification without prior notification. Projections made within the document are based on various market

condition assumptions, and there is no assurance that the anticipated results will be attained. Snowball Investing

disclaims any responsibility for losses incurred due to reliance on this document's content. It is important to note

that Snowball Investing is not offering financial, legal, accounting, tax, or other professional advice, nor is it

assuming a fiduciary role.

Member discussion